A QUARTER of a century later, what was just an idea and perhaps a mobile telephony licence has transformed into one of the biggest listed companies on the Zimbabwe Stock Exchange (ZSE) in terms of market capitalisation and without any doubt a giant in its own right.

The story of Econet Wireless Zimbabwe is a landmark example of indigenous companies’ excellence and will continue to be celebrated.

However, Econet has transformed into a completely different animal than the one that was listed in 1998.

During the journey, it made significant acquisitions including Mutare Bottling company at some point, and TN Bank, which is now Steward Bank, amongst other corporate transactions. Perhaps the most significant was the unbundling of then Cassava SmarTech, now EcoCash Holdings late in 2018.

Econet’s journey has not been all rosy, it came with its trials and tribulations. Most of them relate to balancing economically viable pricing versus regulatory expectations in a dynamic operating environment, which for a significant part of its life has been inflationary.

In the last few years since the unofficial end of the dollarisation, the company has also been facing challenges of securing foreign currency for capital expenditure.

Considering that Econet is a player in the telecommunications space, investment in capital expenditure is key in making sure that you deliver the best service in terms of both voice and data.

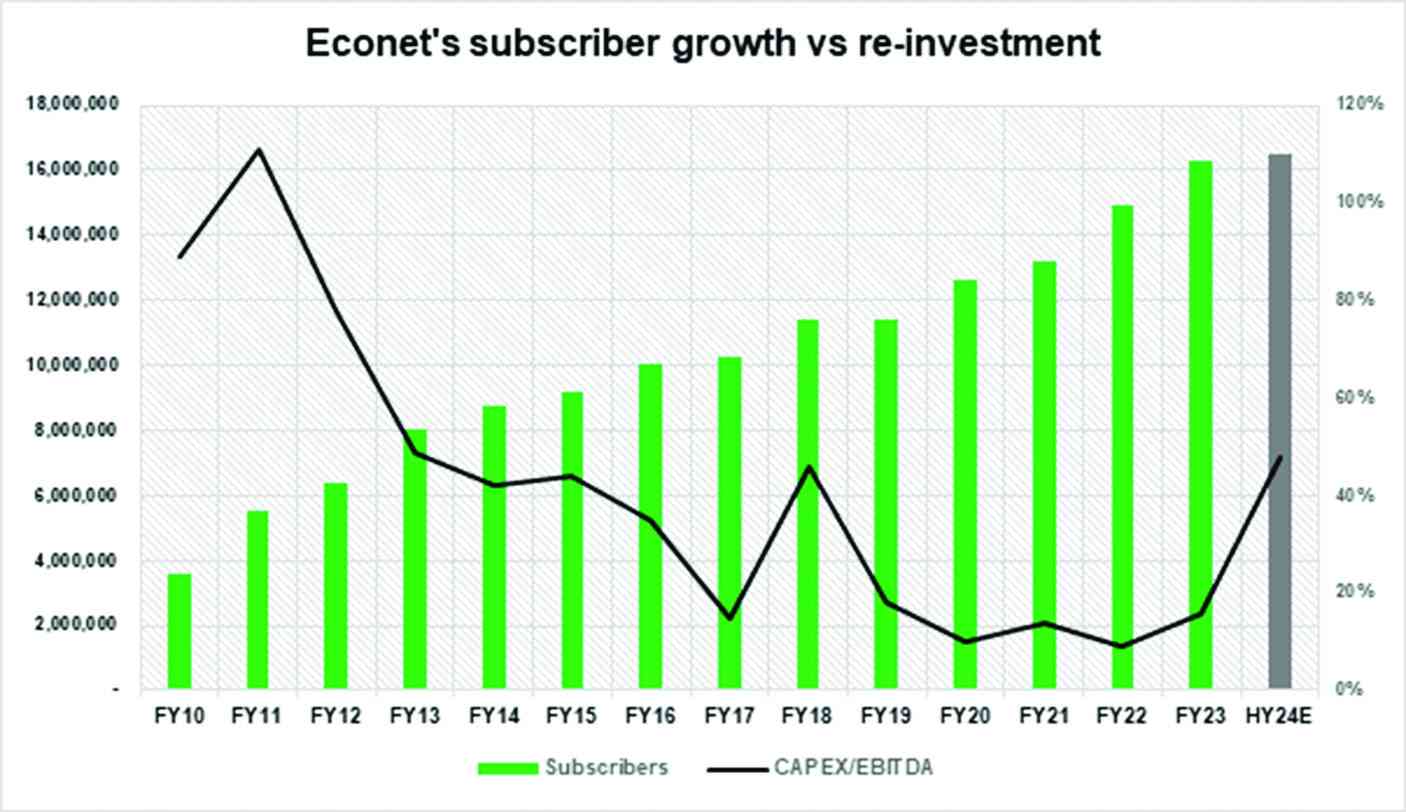

On average, industry standards are to reinvest 30% of revenues back as capex, but due to the headwinds earlier discussed, the company has been falling short of such thresholds, as depicted in the graph below.

- Mboweni mentors emerging entrepreneurs, calls for integrity in business

- Mboweni mentors emerging entrepreneurs, calls for integrity in business

- Zim tycoons elevate offspring to key roles

- Zim tycoons elevate offspring to key roles

Keep Reading

However, in the HY24 results Econet recorded significant progress in its capex that has allowed the company to modernise over 690 base station sites in Harare and Bulawayo over the half year.

The capital expenditure is financed by internal resources. This equipment modernisation exercise is critical in improving the quality and coverage of the service provided by the company.

The company also admitted that the functional currency of the business is changing and leaning more towards the United States dollar, which makes it easier to carry out the capital expenditure projects.

However, despite acknowledging the changing functional currency, the company has not yet changed its reporting currency although management is analysing the implications of such a move.

This makes it difficult for users of the financial statements to extract meaningful insights to help them make meaningful decisions from the financials.

Failure to secure foreign currency, as mentioned earlier has also forced the company to explore several different alternatives such as issuing debentures and engaging in rights-offering exercise.

The debentures that were issued in 2018 were due for redemption earlier this year and since the problem related to accessing foreign currency hasn’t improved, the company ended up going back to its shareholders to seek the money to redeem the debt.

Since this debt was in US dollars, as the local currency depreciated versus the greenback, the adjustment would be recorded in the income statement as exchange losses and this over the years has put pressure on the company’s profitability.

In the HY24 financials, the exchange losses were 34% of revenue as opposed to 39% in the same period the previous year. As the company pays off this liability we anticipate that this line item will significantly reduce.

On an operation performance basis, the company recorded growth both in voice and data usage of 24% and 25%, respectively. This non-monetary metric points to a growing business, which has over two-thirds market share and over 90% of population network coverage.

Over the recent years, the company has witnessed a shift in its revenue contribution coming from voice towards leaning more towards the data usage category.

The company also has shares in Liquid Telecommunications, which is a major player in the data provision space and the stake is reflected on the company’s financials.

Lately, there has been a growing concern in the market over alternative internet service provision by the American company Starlink.

According to the latest numbers, 34% of Econet revenues come from data and internet services and this category is projected to overtake other segments but however, faces the competition from the likes of Starlink.

The regulator of the telecommunications industry, Postal and Telecommunications Regulatory Authority has not been clear on the future of Starlink although the number of users, who are registering in other countries is increasing.

- Hozheri is an investment analyst with an interest in sharing opinions on capital markets performance, the economy and international trade, among other areas. He holds a B. Com in Finance and is progressing well with the CFA programme. — 0784 707 653 and Rufaro Hozheri is his username for all social media platforms.