Zim firm develops smart safes to improve banking

A leading Harare-based company, Unihold Investments, has introduced a technologically advanced smart safe for smooth banking purposes.

By Jairos Saunyama

Feb. 27, 2026

SMEDCO urges tax reform to unlock MSMEs’ growth

By Ruth Maseko

Feb. 27, 2026

Zim lines up exclusive lodges plan for Victoria Falls Airport

By Ruth Maseko

Feb. 27, 2026

Telecoms firm earmarks US$4m for EV charging network

TELECOMS firm Telco Broadband plans to invest about US$4 million to roll out a nationwide electric vehicle (EV) charging and battery swapping network

By Blessed Ndlovu and Concilia Mupezeni

Feb. 27, 2026

London-listed miner Vast plans fresh diamond deals

Chief executive officer, Andrew Prelea, said the breakthrough had opened the door to broader engagement in Zimbabwe.

By Mthandazo Nyoni

Feb. 27, 2026

Elombi says Africa must fix project preparation to unlock infrastructure capital

The AIFF was unveiled on the margins of the 39th African Union Summit under the theme “Strengthening Africa’s Financial Architecture to Finance Agenda 2063”.

By Mthandazo Nyoni

Feb. 26, 2026

Zim @Mining Indaba 2026: Hunting in packs

The participation of Mutapa Investment Fund was publicly noted. The Fund attended as part of its strategy to attract structured investment into strategic mining assets.

By Dennis Mambure

Feb. 20, 2026

Kavango targets 8 000 gold ounces by 2028

Earlier this month, Kavango Resources Plc declared a maiden gold mineral resource estimate of 33 900 ounces at its Bill’s Luck Gold Mine, valued at US$179,26 million at current prices.

By Tatira Zwinoira

Feb. 20, 2026

Why Vision’s debt-to-asset deal with Tongaat collapsed

It entered voluntary business rescue in October 2022 after total claims and debt ballooned to about R13 billion (US$721,6 million), a figure later confirmed at R10,4 billion (US$634,53 million).

By Tatira Zwinoira

Feb. 20, 2026

Forbes border traffic flow outpaces infrastructure

Originally conceived as a tourist crossing, Forbes now competes with, and in some months surpasses, Beitbridge Border Post in truck clearances.

By Ruth Maseko

Feb. 20, 2026

Understanding the Corruption Perceptions Index: What It Measures, How It Works, and Why It Matters for Zimbabwe

In developing country contexts, corruption exacerbates poverty, distorts resource allocation making it both a development and governance concern of global significance.

By Transparency International Zimbabwe

Feb. 20, 2026

Property developers demand tax audit

“There is a silent tiger in property development that, with the right backing, can catapult growth and rank among the top five contributors to GDP,” he said.

By Ruth Maseko

Feb. 13, 2026

Nampak Zim invests despite planned exit

Capital expenditure rose marginally to US$3,62 million from US$3,5 million in the prior year, largely directed towards capacity expansion and plant service improvements.

By Tatira Zwinoira

Feb. 13, 2026

SecZim’s new capital framework aims to attract investors

Total funds under management rose 9,59% to ZiG90,6 billion (US$3,4 billion) in the third quarter of 2025, with exposure to equities climbing to nearly 35%.

By Blessed Ndlovu

Feb. 13, 2026

FBC Securities backs Econet Zim delisting

Maintaining exposure to InfraCo could offer stronger long-term returns, particularly if VFEX liquidity improves and infrastructure assets begin to attract more appropriate market pricing.

By Tatira Zwinoira

Feb. 13, 2026

Trevor & Associates convenes business leaders to tackle economic challenges

The one-day strategic forum, scheduled for February 26, 2026, in Harare, is anchored in a stark premise: Zimbabwean businesses can no longer afford to wait for rescue, reform, or relief.

By Staff Writer

Feb. 6, 2026

AMH to host Zim ESG & investment summit

Agriculture discussions will centre on climate-smart practices, resilient supply chains and access to finance and technology required to meet export market sustainability standards.

By Blessed Ndlovu

Feb. 6, 2026

Premium

ZimTrade revives regional warehousing facilities push… state agency shifts to aggressive in-market export strategy

By positioning goods closer to end markets, the strategy is expected to reduce delivery times, lower entry costs and allow exporters to respond more effectively to shifts in demand.

By Mthandazo Nyoni

Feb. 6, 2026

Premium

Zimplats invests US$29m as major projects advance

Zimplats said studies to assess the viability of pillar reclamation mining at Mupfuti will be conducted this year, followed by a trial should the studies prove successful.

By Tatira Zwinoira

Feb. 6, 2026

Mutapa moves to commodity-based mining structure to unlock value

“We are unveiling a comprehensive restructuring that transitions us from a broad holding model to specialised, commodity-specific verticals,” Chinyemba said.

By Mthandazo Nyoni

Feb. 5, 2026

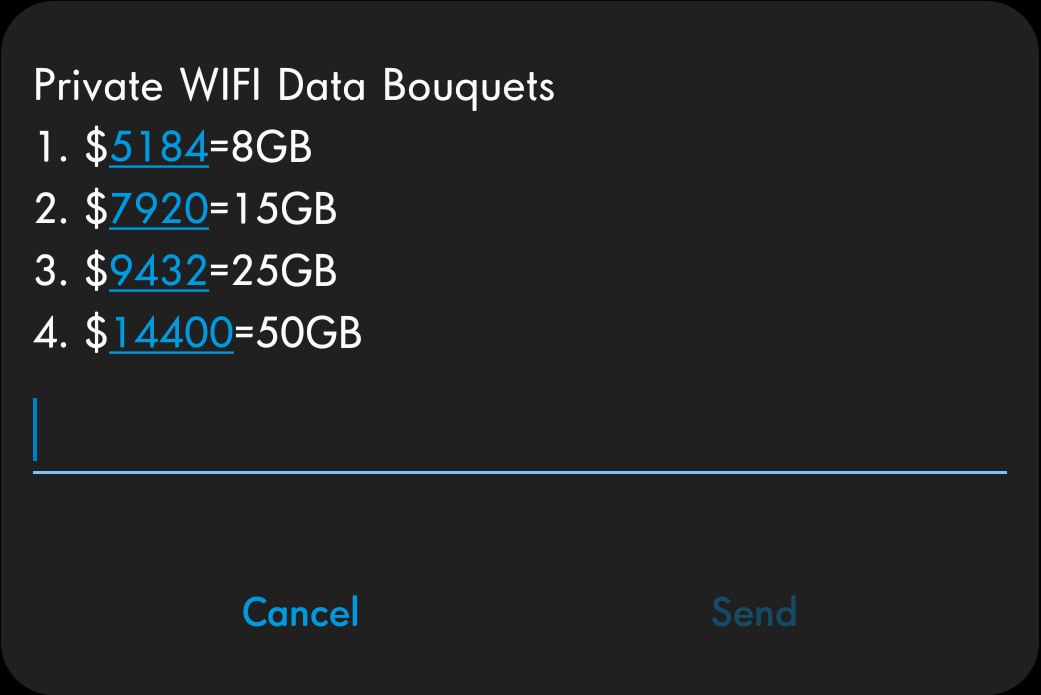

Why does the data we buy expire, yet it does not rot?

Whether you are on Econet, NetOne or Telecel, we are buying bundles that come with a ticking clock. When time runs out, our paid-for megabytes vanish.

By Phillan Zamchiya

Jan. 31, 2026

Australian, Hong Kong investors advance the Dokwe Gold project

Tranche 1 delivered AU$8 million (US$5,57 million) in immediate funding for working capital, metallurgical test work and the definitive feasibility study (DFS).

By Tatira Zwinoira

Jan. 30, 2026

ZSE counters face selective gains

By contrast, the ZSE remained highly concentrated, with market capitalisation rising to US$3,5 billion, but dominated by Delta and Econet.

By Mthandazo Nyoni

Jan. 30, 2026

Shuntai targets mid-June supply as US$120m Chegutu cement plant nears completion

Cement manufacturer Shuntai Investments Private Limited is on track to commission its US$120 million cement plant in Chegutu within the next six months

By Belinda Chiroodza

Jan. 29, 2026

Nedbank Zimbabwe MD Sibongile Moyo quits

Nedbank Zimbabwe has announced the resignation of its Managing Director, Sibongile Moyo, who has stepped down to pursue private interests after nearly six years at the helm.

By Staff Reporter

Jan. 26, 2026

Afreximbank earns prestigious global risk management certification

Kagumya explained that the Risk Management Framework provides a bank-wide approach to managing risks and safeguarding the Bank’s goals.

By Mthandazo Nyoni

Jan. 23, 2026

Ipec calls for policyholder protection

The sector also continues to struggle with policies lapsing after sale. Policy lapses are mainly attributed to affordability issues and changes in policyholders’ circumstances.

By Gamuchirai Nyamuziwa

Jan. 23, 2026

How Rudland built behemoth in cut-throat tobacco industry

“Over time, I identified agriculture, particularly tobacco, as a sector with both strategic importance and long-term growth potential in southern Africa,” Rudland told businessdigest.

By Nhau Mangirazi

Jan. 23, 2026

Regulatory hurdles slow ZimRe’s capital drive

“The target raise is a strategic aspiration that the group desires to attain,” ZimRe group chief operating officer Chakanyuka Nziradzemhuka told businessdigest.

By Concilia Mupezeni

Jan. 23, 2026

‘Econet de-listing likely to boost Delta’

FBCS warned, however, that Econet’s exit would force a structural reset of the ZSE, given the company’s historical role as a blue-chip hedge against macroeconomic instability.

By Tatira Zwinoira

Jan. 23, 2026