IN a fast-paced global economy, every industry needs to keep jogging in order to stand still. A continuously relevant, client-centric, and evolving industry, by any measure, is one that is self-regenerative.

To what extent that can be said about the pension fund industry remains a topic for a robust debate. Caution is though called for, lest old products are simply recycled, repackaged, and re-introduced to the consumers under a different, and more appealing, name.

There are those that have looked at the fairly new phenomenon of umbrella funds and have wondered if it is not the same case here. We hold a view on this.

Insured funds

Insured funds, also called underwritten funds, are where a retirement fund is strictly invested in policies of insurance with an insurer only. The fund has no other assets besides policies of the particular insurer.

Effectively, a relationship is established that is governed by terms and conditions of long-term insurance policies as issued by an insurer to the fund.

The insurer owns the fund’s assets, and the fund is a policyholder. However, the assets are and remain those of the fund – and not the insurer.

The insurance policy is only a legal framework for housing the assets of the fund with the fund now owning an insurance policy and the assets being in the name of the insurer. The insurer also doubles as the administrator.

Originally designed for small-to-medium-sized funds, along the way the provision was extended to even some of the biggest funds in our market today.

Small-to-medium-sized funds were considered ideal for this plan with the argument that it would not be economically viable for them to arrange their own separate investment management, or other services separate from the fund administrator.

By law, insured funds may be exempt from certain provisions of different relevant Acts. There are terms and conditions though that need to be satisfied for eligibility.

These include, but are not limited to, that they do not have their own bank accounts and they do not own any assets other than long-term insurance policies.

They also do not have any liabilities other than the liabilities underwritten by the insurance policies, one insurer must act as the administering insurer, contributions received from individual fund members or employers are credited directly to bank accounts held in the name of the insurer, and that any benefits paid are paid directly by the insurer.

Umbrella funds

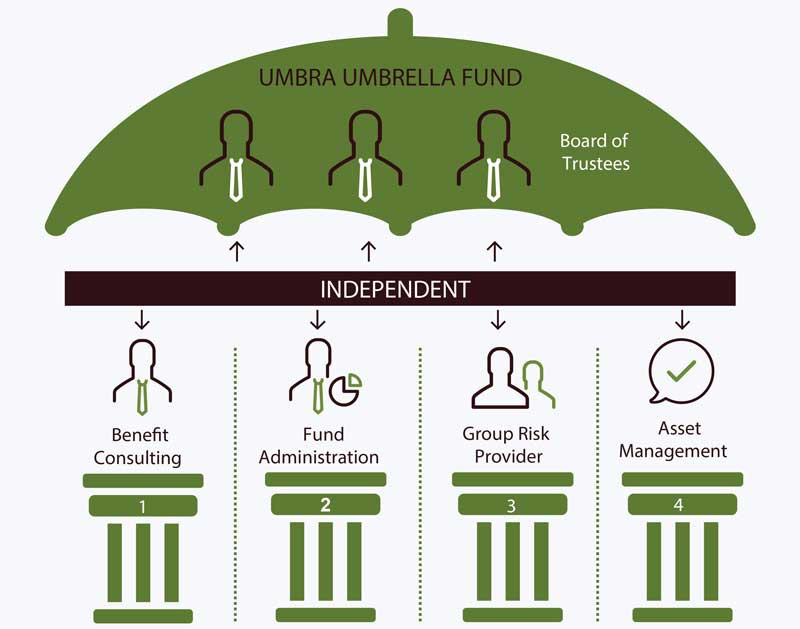

While the pooling and economies of scale argument squarely applies to umbrella funds too, there are marked differences between the two models of meeting workers’ retirement savings platform needs.

For starters, umbrella funds are not limited to policies of insurance. Where they do own insurance policies, this is purely as part of a deliberate and wider investment strategy. These funds have their own bank accounts and have the choice to appoint either an insurer or a specialist administration firm as their preferred administrator.

Whether insourced or outsourced, the administrator’s key role is to administer contributions and benefits paid into and out of the funds, respectively.

The administrator is also responsible for administering payments to and from other service providers, including but not limited to, actuaries, investment managers, custodians, investment consultants, risk advisors, and other advisors.

Why insured funds?

Historically, insured fund plans have taken different forms but the few worthy of mentioning are group deferred annuity contracts, group deposit administration contracts, immediate participation guarantee contracts, separate accounts, and guaranteed investment contracts.

What we have in our market seems to be mostly the modified remnants of the old group deposit administration contracts – the key modification being the lifting of any minimum return guarantees on the funds’ investments.

Traditionally, insured fund arrangements have been viewed to have a lot of advantages relative to self-administered funds.

Due to the limiting technological advancements of the time, the complexity of securely administering retirement savings was considered the preserve of insurers – whose actuaries were considered properly trained for discharging the responsibility at hand.

Insured funds seemed the most ideal plan through which to achieve the objective of housing retirement savings.

Pension funds under the custodianship of an insurer benefit from another layer of oversight and control over and above that maintained by the board of trustees.

The insurance policy dictates that the insurer manages and administers the welfare of the funds with due care, prudence, diligence, and skill as a prudent person would manage their own assets.

This provides another line of protection for members. It also minimises the likelihood of things going terribly wrong with the fund, and further shields the trustees from exposure to significant liability.

Whether it was to guarantee the capital amount, non-negative returns, a minimum level of positive returns, smoothing of declared bonuses, or a specified annual return over a certain period, traditionally this has made insured fund schemes an attractive option for funds.

Today though, a combination of capital guarantee and bonus smoothing, in their variety of versions, seem the only remaining key distinguishing feature of insured funds.

However, these are now rarely offered as the only investment choice. Instead, these guaranteed funds or bonus smoothing solutions are now offered together with a wide range of market-linked investment

products as well. This offers funds a much wider range of investment options to choose from – including products from other insurers as well as independent, non-insurer-tied, asset managers.

Market-linked, as the name suggests, come with no investment guarantees at all. When they are available through an insured fund arrangement, they are merely investment portfolios wrapped in an insurance policy.

There are no investment guarantees at all. The fund will get whatever the asset manager generates – including both zero and negative returns. The "insurance policy" is, in a sense, in that it is the insurer that has meticulously and thoroughly done the required robust due diligence of researching and availing the third-party asset managers under the insured fund platform.

So, the investment is "safer" in the sense that it has been chosen by a competent and well-resourced insurer as opposed to a board of trustees who may not be investment management experts.

More importantly, the insurer undertakes this rigorous process as it guarantees that even should the asset manager in its range of portfolios goes under, the investment of the fund would still be very much well protected through the insurance policy.

So, the guarantee that remains, where the insurer has market-linked portfolios on its platform of available portfolios, is that of non-investment type of risks.

These would include risk of loss of investments as a result of fraud, negligence, theft at the asset manager, and other risks of an operational nature.

Where an employer opts for the insured fund arrangement, they are effectively offloading the burden of managing and administering a pension fund to the experts. This then allows the employer to focus a lot more on its core business.

Furthermore, with this arrangement, there is only one party the employer needs to deal with, the insurer, – effectively providing room for building robust and mutually beneficial communication lines between the employer and the insurer.

With insured fund schemes, by participating in a pool of other similar funds, each individual fund benefits greatly from economies of scale. Pooling gives the insurer the required size to be able to influence the fees at which it receives any services.

This includes even asset management fees where it outsources some of those products that are accessible on its platform. Small-to-medium- sized funds particularly benefit from this.

Funds that are generally big in absolute terms but not as big relative to the pooled arrangement of the insurer would also benefit from opting for an insured fund arrangement.

For the regulator, where the providers of schemes for housing retirement savings are few and offered only by insurers with stable and strong balance sheets, it makes the provision of the ideal regulatory environment a lot more focused and precise.

How relevant do they remain?

This insured fund structure is not without its own shortcomings though. Key amongst these is its lack of flexibility on the range of investment options available to the fund.

The insurer will provide mostly its own in-house investment policies with a few from either other insurers or wrapped strategies from independent asset managers.

Largely, the insurer is most likely to stick with only known and more common investment solutions thus denying the funds opportunities for gaining exposure to more exotic and newer investment strategies.

The guaranteed funds, which are usually the main offering of the insured fund plans, not only do they come with a heavy charge for the guarantee, there is also a covet opportunity cost in the way the underlying assets are invested.

The assets are most likely to be invested conservatively to minimise the chances of the assets performing poorly with the risk of negatively impacting the insurer’s solvency position.

There is also the issue with the potential for generational transfer of wealth as returns in good years are set aside for the rainy days. With defined contribution schemes, the more common standard globally is now to allocate returns on a monthly basis, with the more developed economies now even making daily allocations.

This effectively ensures that members leaving the fund at any particular point leave with the actual accumulations their contributions would have earned over their period of membership.

Furthermore, the real structure of guaranteed funds has, to this day, not been generally understood by both members and practitioners alike.

It has remained a complex investment offering that only a few in the market fully understand – and certainly something that members struggle with wrapping their heads around. Where market-linked investments are offered, there are no investment guarantees at all and the funds’ gross investment performance is the same as what the fund would have achieved had it invested directly in the markets.

There is no smoothing either – so members are equally exposed to the volatilities of the market as the fund itself.

Are umbrella funds the solution?

A general perception of the opaqueness of how insurance policies work, and the general bad taste that insurance contracts have left in many people’s mouths, is what has pushed some in the industry to take a closer look at the continued appropriateness of this type of plans going forward. Pension funds in general, could be more appealing if only they could improve on transparency and flexibility.

The opacity of insured funds is also a challenge from a regulatory perspective.

It is not in doubt that insurers operate some of the most complex business models with balance sheets that are composites of comingled assets of different stakeholders with complex financial interests and obligations themselves.

This, in the case of insured funds in particular, is further complicated by their exemption from submitting the same returns to the regulator as is required of their self-administered counterparts. Key amongst these are audited financial statements and actuarial valuation reports – both of which are critical for an effective discharge of the regulator’s compliance oversight and monitoring role. The perceived high walls of knowledge-barriers behind which insurance firms operate need to be broken if insured funds are to remain a viable option for housing retirement savings.

One of the biggest challenges we are grappling with today is that of the observed behaviour from members of utter disengagement with their retirement saving matters.

While a general perception that insurance products are difficult to understand is one contributor, there is also a false sense of financial security that they entertain on the belief that because their retirement savings plan is with a large household insurer brand their retirement is secure.

When they finally learn that this is in fact not always the case it would be already way too late, and they would have benefited a lot had they engaged with their retirement savings matters much earlier in their careers.

If we are to succeed on the war to take more members to a comfortable retirement, getting them to heartedly engage with their retirement savings every step of the way is certainly one of the many battles that need to be won at the very minimal. What is clearly observable from other industries is that member-centric technological initiatives are effective behaviour changers.

Equally observable is that the financial services industry has been quite slow in adopting these technological advancements in comparison to other industries.

New innovative ways of providing retirement saving platforms need to be explored if the dream of a decent life in retirement is to be realised for most of our people. Umbrella funds come with almost all the strengths of insured funds and yet with none of their weaknesses. For instance, the pooling mechanisms and the economies of scale benefit is equally applicable to both. However, while the opacity and inflexibility of insured funds is well documented, umbrella funds, where they are properly structured, are anchored on transparency with a key focus on flexibility and cost- effectiveness.

They are also driven by a direct member-centric emphasis, powered by an acute pursuit of technological savviness.

Conclusion

It would appear time has come for the insured fund model to self-regenerate into the umbrella fund model, retaining all its strengths while dumping all its shortcomings for a more transparent, more flexible, and more cost-effective retirement saving plans regime.

- Mukadira is a consulting actuary at Rimca — [email protected]); Gandidzanwa is an investment consultant at Rimca — Gandy@ rimcasolutions.com.