GENERALLY, monetarists believe that price inflation is always and everywhere a monetary phenomenon. This view holds for Zimbabwe, a country that has struggled to enjoy durable stability whenever it has access to money printing machines.

The local currency is injected into the system at a faster pace than the rate of growth of economic activity in the real sector.

Since the introduction of the Zimbabwe dollar (ZWL) in 2019, the Reserve Bank of Zimbabwe (RBZ) has tried to implement a myriad of policy actions to clamp instability including the enactment of an infamous ban on all commercial bank lending.

In addition to gold coins, which have failed to arrest incessant Zimdollar and price instability, the Bank is now introducing digital gold tokens. The column, therefore, seeks to explore the benefits and likely shortcomings of gold tokenisation.

The RBZ introduced gold coins in July 2022 in an attempt to clamp incessant Zimdollar decline and out-of-control price inflation by reducing the domestic demand for the US dollars (USD) and mopping excess ZWLs in circulation.

RBZ statistics show that as of March 10 2023, a cumulative 31 866 gold coins had been sold for more than ZW$25,8 billion (US$1:ZW$1 078 as at May 8).

However, price developments show that the injection of gold coins is outpaced by the injection of new Zimdollar liquidity into the economy as fiscal spending escalates ahead of the 2023 harmonised elections.

This is exerting excessive borrowing pressure on the Treasury. Latest RBZ statistics show treasury bill (TB) issuance gaining 4% in February 2023 to reach ZW$332,6 billion. In year-on-year terms, issued TBs mounted by a staggering 576% from ZW$49,2 billion in February 2022.

- RBZ blocks Harare US dollar charges

- Industry cries foul over new export surrender requirements

- One stitch in time saves nine

- Banks keep NPLs in safe territory

Keep Reading

Increased fiscal spending coupled with rising quasi-fiscal operations from the RBZ is creating excess Zimdollar liquidity and destabilising the exchange rate.

Latest February 2023 statistics show ZWL-denominated broad money (M3) spiking by 13,2% to ZW$1,21 trillion from January 2023 levels. In annual terms, the monetary aggregate registered a 334% growth from ZW$279,38 billion attained in February 2022.

Disaggregating M3 into Zimdollar and US dollar components removes the effect of exchange rate movements. As such, these statistics are showing unsustainable growth in money creation putting pressure on Zimdollar prices to mount.

The latest April 2023 inflation statistics show the weighted consumer price index (CPI) gaining 2,3 percentage points on March 2023 rate of 0,1%.

The increase in April blended inflation rate is the biggest monthly jump since June 2022. Elevated inflationary pressures particularly for Zimdollar transactions are largely emanating from the massive deterioration of the local currency against the US dollar in both markets.

In year-to-date terms, the Zimbabwean dollar has lost about 34,7% and 55% on the official interbank and alternative markets respectively. Largely due to forex liquidity challenges in official markets, businesses are forced to benchmark their Zimdollar prices at or above the parallel rate. Yet, RBZ exchange regulations allow only for a 10% margin above the prevailing official rate.

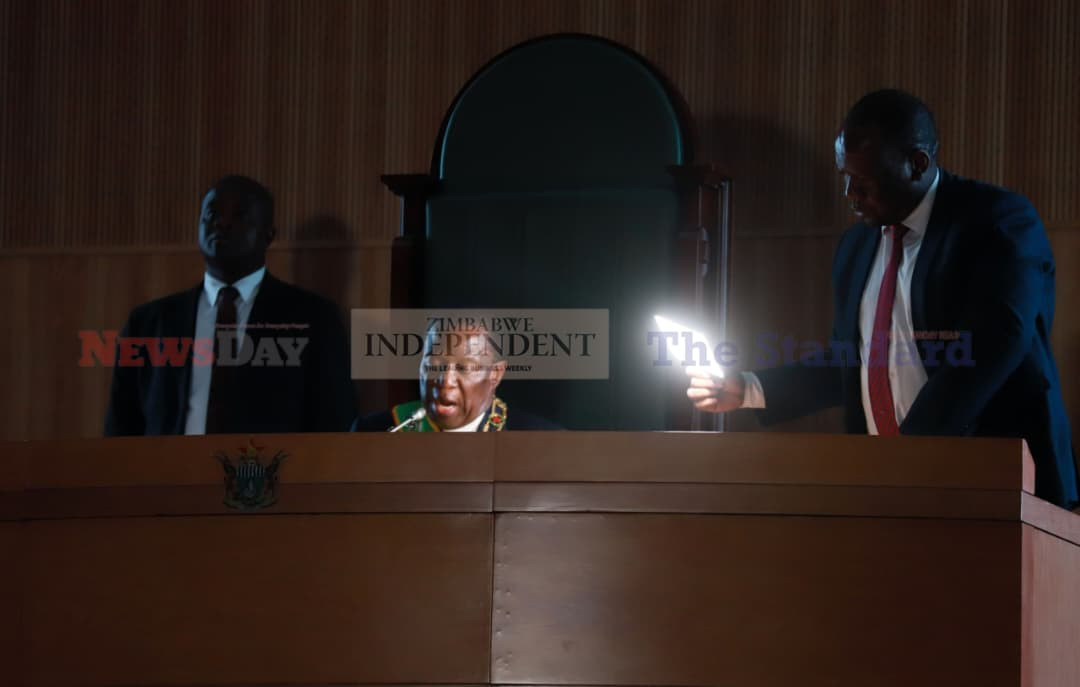

Apart from the exchange rate pass-through to inflation, price inflation is also being fuelled by prolonged electricity load-shedding (rationing) schedules.

Generally, electricity is a critical production enabler, its scarcity is an albatross to domestic production as it increases business operating costs.

In addition, fragile global supply chains due to the Russia-Ukraine war are sustaining global inflation thereby disproportionately affecting net-importing nations like Zimbabwe through imported inflation -mainly high prices of food, fertilisers, and fuels.

With Zimdollar and inflation running amok, the monetary authority has now introduced digital gold tokens. Tokenisation operates on the premise that the use of technology, such as distributed ledger technology (blockchains) enables the conversion of real-life tangible assets, such as gold into digital tokens representing them.

These can be further split into fractions, meaning that everyone can own a part of the asset they are keen on without possessing a large financial capital.

The gold-backed digital tokens were to be issued with effect from May 8 2023. The tokens will be fully backed by physical gold held by RBZ and shall be introduced in two phases; Phase 1 where gold-backed digital tokens (e-gold cards/wallets) will be issued for investment purposes and Phase 2 where digital tokens will become tradable and capable of facilitating person-to-person (P2P) and person-to-business (P2B) transactions and settlements.

Generally, gold is considered a safe haven investment during downturns and financial crises because of its long history of use as a store of value.

Helping it achieve this status are its properties: malleability, portability, aesthetic appeal, virtual indestructibility, universal acceptance, liquidity, and rarity.

So, hypothetically, the gold-backed digital tokens complementing the physical gold coins will deepen Zimbabwe’s shallow financial markets, slow ongoing rapid economic re-dollarisation, and strengthen the Zimdollar. To extract the maximum benefit, the RBZ must adopt advanced technologies, such as distributed ledger technology, which guarantees transparency and efficiency of transactions and are even difficult to disrupt.

Also, advanced technology ensures that all transactions are safely recorded as no documents can be falsified since all data is immutable — it cannot be modified by any person. This will circumvent the dangers of reliance on centralised traditional database systems. These are highly prone to manipulation, may be hacked, and are susceptible to genuine human error.

The tokenisation initiative also requires frequent auditing of gold reserves (backing the digital tokens) in RBZ vaults by reputable and independent audit institutions.

This will help avoid prior experiences with bond coins, which were introduced in 2014. The RBZ introduced the bond coins on the pretext that they were supported by a US$50 million facility extended by the African Export–Import (Afreximbank) bank.

Over time, it emerged that authorities minted the coins beyond their collateral limit due to a lack of frequent audits. The bond coins ended up trading at a premium to the US dollar as opposed to the official 1:1 fixed rate.

So, if there are no trusted audits of the quantum of gold reserves in vaults versus issued digital tokens, the tokens risk suffering the same fate as bond coins. More so, there is a great need to guard against gold leakages caused by theft and fraud.

Nevertheless, in reality, the use of gold or its variants will likely fail to ameliorate the fragility of the local currency and resultant chronic inflation.

This is mainly due to dwindling market confidence and trust in the government, which consistently exhibits policy inconsistencies and lacks transparency and accountability – rising corruption cases perpetrated by both elected and unelected public officials.

Zimbabwe also lacks adequate infrastructure to support advanced technologies which are key in ensuring gold production tracking and monitoring to minimise chances of gold leakages and illicit trading.

Traceability measures help in curbing criminality as information, such as the exact source of gold, holder of gold buying licence, and amount of taxes paid on gold exports can be collected and analysed.

Official statistics, which are too conservative thanks to Al Jazeera’s Gold Mafia documentary indicate that the nation is losing a staggering US$1,2 billion annually to gold smuggling alone.

These rampant illicit flows will militate against the accumulation of gold reserves, which are crucial in supporting the value of gold e-cards. Enabling smuggling are porous borders and ports of entry. The Mines and Minerals (Minerals Unit) Regulations of 2008 (SI 82) established a crack unit, Minerals Unit, composed of the Ministry of Mines, the police, and RBZ.

This Minerals Unit, however, seems to have been captured by a gold smuggling syndicate. It is also demonstrating severe constraints in discharging its mandate partly due to excessive political interference in gold mining, marketing, and trading decision-making.

Furthermore, the nation lacks a clear gold policy. The current policies are not hinged on a clear policy framework for the exploration, production, beneficiation, marketing, and management of gold thus creating room for policy reversals and inconsistencies.

Also, there is a limited political will to fully implement direly needed economic and structural reforms to strengthen institutional and regulatory framework, curb leakages, improve social fairness and inclusion, thwart fiscal indiscipline and impunity, and eliminate prevailing excessive pricing distortions inhibiting market competition and innovation.

- Sibanda is an economic analyst and researcher.He writes in his personal capacity. — [email protected] or Twitter: @bravon96