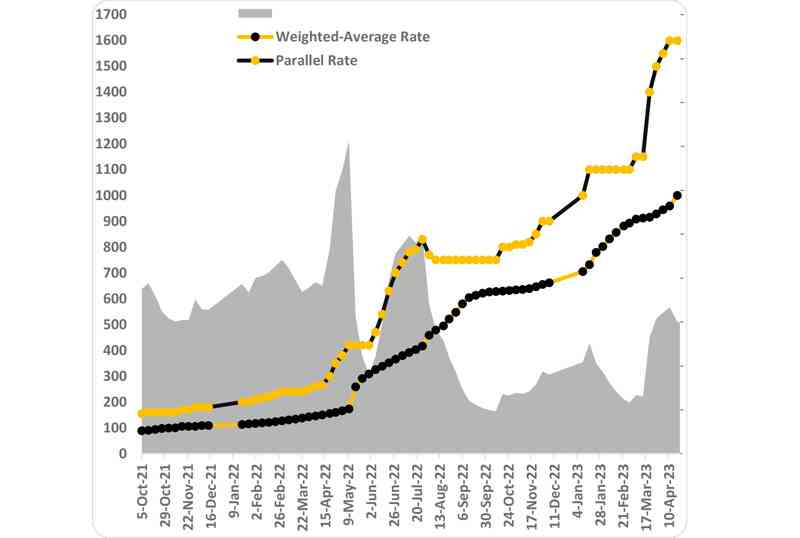

IN the week under review, the Zimbabwean dollar pared 4% against the greenback on the formal market, its worst performance in 12 weeks and the second since the beginning of the year.

This week’s auction was delayed due to the Independence Day holiday. The rising pace of decline is largely due to a lagging factor.

The auction market has not paced up the parallel market in terms of losses. The parallel market has seen wider losses amounting to about 38% on a year-to-date basis, while on the formal market the local unit has pared by 32%.

The current pace of losses on both markets is ahead of all the past four years since the reintroduction of the local currency.

The currency’s performance follows a growth in money supply stimulated by government’s issuance of Treasury Bills (TBs) as settlement for outstanding dues.

Given the prevailing monetary dynamics, it is quite clear that the economy is not in a position of stability and the outturn may worsen over the next few months, given the liberal stance pursued by government.

Government, and particularly monetary authorities contend that the market has been stable and at the latest sitting of the monetary policy committee, it alluded to sustained monetary tightening as having a positive impact on currency stability.

While relative stability was enjoyed for the greater part of the second half of 2022, the trend has not been carried forward into 2023. Much of the stability enjoyed in 2022 was due to liquidity mop ups, which are not a demonstration of a strengthening economy.

- Mayhem as schools reject Zimdollar fees

- Prices continue to skyrocket

- Feature: Zim-A country at yet another crossroads

- One stitch in time saves nine

Keep Reading

Much of the liquidity was syphoned through gold coins and various money market instruments. Other measures targeting the financial sector such as interest rates and capital gains were enforced, but with downside impact.

What is apparent from the overall depreciation of the currency in 2021, is that the local liquidity continues to outpace forex. In 2022, forex generation surpassed US$12 billion, with FCA rising above the US$2 billion by the end of the year. This, however, did not deter the currency from easing by about 86% against the greenback.

In our view this is a mere reflection of the pace of currency injection, which continues to outpace forex generation. In the same manner we have looked at stability in relative terms, monetary tightening has relatively improved compared to prior years, but this comparison is inconsequential when looked at in relation to the flow of forex.

As long as the injection of currency is above the inflow of USD, the status quo of a worsening exchange rate will be sustained.

The stance on money supply, which entailed a relative constriction (period against period) is not entirely a tightening when looked at in the context of available USD over the respective period, which is the only explanation for a depreciating Zimdollar.

Now this is in past terms given the evolving monetary dynamics. The monetary policy stance has somersaulted and is now loose as evidenced by massive money minting exercise from the TBs issuance.

Government is releasing TBs to the tune of US$1,5 billion and these have an enormous effect on money supply.

For context, government has not released TBs with a combined value equivalent to US$1,5 billion over a cumulative period of three years, that is between 2019 and 2021.

The last time a sizeable chunk of such proportions was released to the market is in 2018, which again was an all-time high.

The similarities of these periods are that the former was also an election year and as is typical, these periods are characterised by deliberate efforts to prop up spending.

As part of the election year spend, massive civil service wage bill increases in real terms have been sanctioned. These combined forces will invariably continue to negatively impact on the exchange rate in the short run.

In the interim, further liberalisation of the exchange rate is required to restore production. It is difficult to see how government will achieve this given the anticipated sudden spike in local currency denominated liquidity.

Forward pricing and liquidity management focused on value preservation without hampering companies’ ability to meet short term demand and losing out to competition is required. Fast mobbing consumer goods and the banking sector can also capitalise on the short-term demand to maximise profitability. The widening premiums largely negatively impact on commodities exporters’ profitability and strategies of value preservation, such as tactical drag in production, can be deployed.

- Gwenzi is a financial analyst and MD of Equity Axis, a financial media firm offering business intelligence, economic and equity research. — [email protected]