TATIRA ZWINOIRA SEVERAL experts have raised concerns over the gold coins’ tradability and begging questions around how these coins will convince people to part with their Zimbabwean dollar and foreign currency for the new store of value.

During deliberations of the central bank’s monetary policy committee on June 24, it was announced that the Reserve Bank of Zimbabwe (RBZ) would introduce gold coins as an alternative store of value.

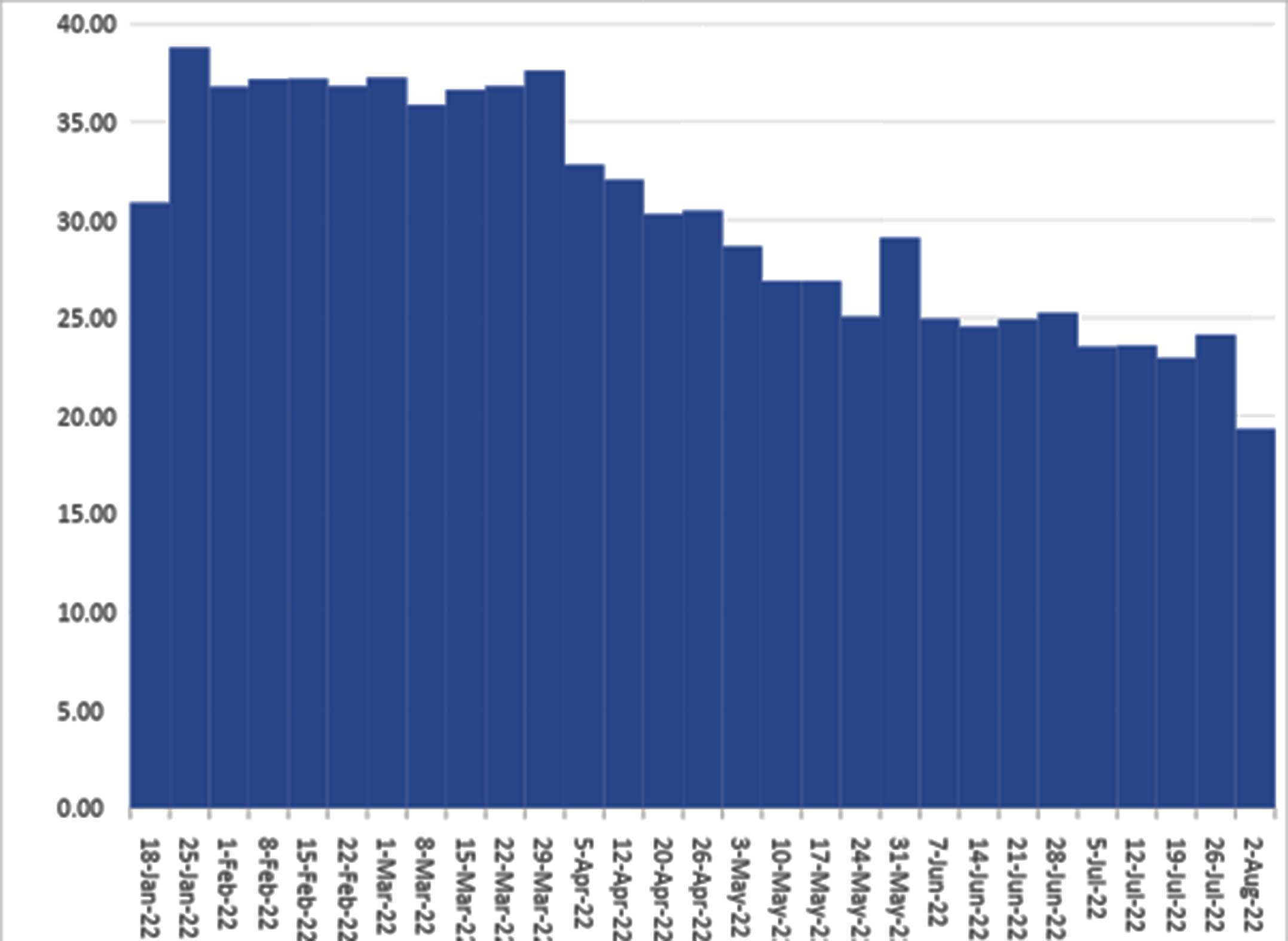

This is because the Zimbabwean dollar continues to depreciate, reaching a current ZW$379,22 to the United States dollar, down from ZW$108,66 at the beginning of the year at the official forex auction.

To counter the depreciation of the local currency, the economy is dollarising.

Just last month, the government had to codify the use of the greenback into law.

The RBZ introduced the gold coins to offer greenback holders an alternative store of value in exchange for the Zimbabwean dollar and the USD.

“The idea was to reduce the very high demand for the United States dollar by offering an alternative and equally valuable asset in terms of gold. That high demand is what is worsening the situation,” an RBZ source told the paper.

However, questions have risen around the tradability of these gold coins.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

One coin will weigh about 31 grammes with a 22-carat purity and will be tradable locally and internationally, convertible to cash. The coins can be used as collateral for loans, and have liquid and prescribed asset status.

“They have to provide mechanics further to this because there are a lot of grey areas. At what stage are you allowed to dispose of the coin?” a mineral expert queried.

“And at what rate? Because if I acquire, say for example, at a certain bank rate that they say is the prevailing rate, then it so happens that the prevailing rate has been eroded or there is an adjustment, what happens in between?”

The expert went on: “Am I going to be allowed to recover the full amount or at a profit from whatever amount I would have paid. Gold is volatile, it goes up and down. It is not a price where you can say it’s US$4 and it remains like that forever, it’s cyclical. Then, in terms of purity, if they are to say is 22 carat, its fine, but the public would want to know why at 22 carat instead of 24 carat.

“At 24 carat, that is bullion (a high standard of purity), so if I am to export it out of the country, in terms of paper trail and questions being asked outside, what answers can I give? Are they also liberalising gold exports? Because according to the Gold Trade Act, Fidelity Printers and Refiners has the sole right to export, so are they now saying it is a free for all?”

“They can only do that if there is Statutory Instrument to amend the Gold Trade Act or a parliament amendment to allow anyone to export the mineral,” the expert said.

The point on the legality of the sale of gold coins amid the regulations of the Gold Trade Act was also raised by lawyer and Citizens Coalition for Change (CCC) spokesperson Fadzayi Mahere.

“This illegal press statement by @ReserveBankZIM violates Section 3 of the Gold Trade Act which criminalises the possession and trade of gold in the manner proposed,” she said wrote on Twitter last week.

“You can’t wake up and pretend the rule of law doesn’t exist. Gimmicks won’t fix the economy. We need new leaders.

“Where is the legal framework for this? Rule by decree offends Section 68 of the Constitution. You can’t create an instrument of trade by a press statement. How does this reconcile with laws governing the trade of gold that are currently in force? What a mess,” she said.

Section 3 of the Gold Trade Act states that: “(1) No person shall, either as principal or agent, deal in or possess gold, unless— (a) he is the holder of a licence or permit; or (b) he is a holder or tributor; or (c) he is the holder of an authority, grant or permit issued under the Mines and Minerals Act [21:05] authorising him to work an alluvial gold deposit; or (d) he is the employee or agent of any of the persons mentioned in paragraphs (a), (b) and (c) and is authorised by his employer or principal to deal in or possess gold in the lawful possession of such employer or principal; and deals in or possesses gold in accordance with this Act and the licence, permit, authority or grant, if any, held by him”.

There are also questions around the exchange rate disparity which can create arbitrage.

Currently, the official forex rate is US$1: ZW$379,22 compared to the parallel market rate at US$1: ZW$750.

“It will create a situation where people are going to invest in gold using local currency then they are motivated to export to get foreign currency,” another market analyst said.

Economist Prosper Chitambara also believes there could be arbitrage.

“That is likely to happen given the widening black market premiums and every investor would want to take advantage of every arbitrage opportunities to maximise their gains. Given that, there is going to be a lot of speculative and arbitrage trading of the gold coin,” he said.

Chitambara said the coins would provide some measure of stability but added that until fundamentals were put in place.

Former finance and economic development minister Tendai Biti suggested that the government should have just used the gold to back the ailing Zimbabwean dollar.

“Running an economy requires a philosophy, strategy, ideas and competency. The Zimbabwe dollar is in tatters due to among other things, lack of reserves and the absence of anything to back it up. There is, therefore, no sense in selling gold when it can be used to back up the tattered currency,” Biti wrote on Twitter.

“Selling gold particularly in local currency allows cartels with billions in Zimbabwe dollar to hedge same with gold the same way they have been buying the US$ on black market. It also allows foreign crooks to launder their money in Zimbabwe via gold coins. Only a kakistocratic state does this.”