Morgan & Co THE Minister of Finance and Economic Development presented the 2022 Mid-Term Budget and Economic Review on July 28 2022 that provided an update on the performance of the economy and the progress on the 2022 budget implementation during the first half of the year.

The presentation was done under the 2022 Budget theme “Reinforcing Sustainable Economic Recovery and Resilience”.

Morgan & Co Research notes that the 2022 National Budget was premised on revenue collections of ZW$850,8 billion (16,8% of GDP, US$1,7 billion at US$1:ZW$494 auction rate) and expenditures of ZW$968,3 billion (target budget deficit of ZW$76,5 billion/ 1,5% of GDP).

The unaudited outturn during the first half indicates revenue collections of ZW$506,6 billion, against expenditures of ZW$534,5 billion, resulting in a budget deficit of ZW$27,9 billion, against a target deficit of ZW$45 billion.

Development partners complemented fiscal resources with an amount of US$190 million having been disbursed towards various projects and programmes.

Of this amount, bilateral partners contributed US$164 million and multilateral partners US$26 million.

Expenditure dynamics The minister of Finance and Economic Development indicated that several constraints emerged during implementation of the 2022 Budget such as:

Requirements to review salaries to improve the welfare of civil servants;

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

Increase in requests for funding, including for unbudgeted expenditures;

Depreciation of the local currency (ZWL) and erosion of budget provisions;

Increases in international prices of fuel and other critical raw materials, among other key services that have rendered most budget allocations inadequate; and

Rescoping of critical components in some projects due to unforeseen circumstances.

As a result, cumulative expenditures for the first six months of the year amounted to ZW$534,5 billion, against a target of ZW$431,2 billion, resulting in a 19% overrun.

Of this amount, recurrent expenditures amounted to ZW$393,1 billion, against a target of ZW$286,5 billion.

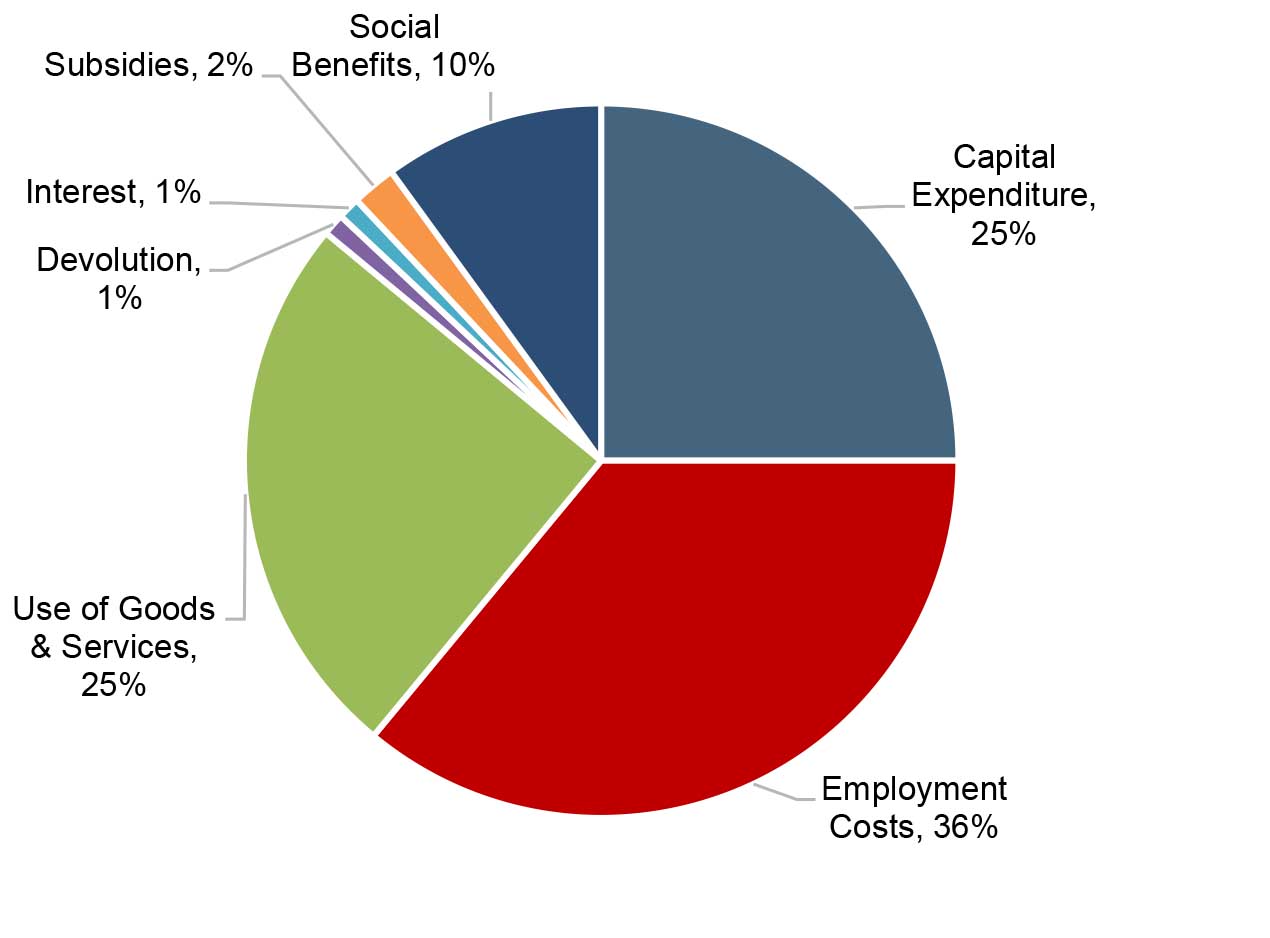

In terms of composition, compensation of employees comprising the wage bill, salaries of staff at extra-budgetary institutions and pensions dominated the expenditures at 36%, followed by use of goods and services at 25% with capital expenditures at 25%.

Our concerns around the national budget include (i) a lean tax base given the rapid informalisation of the economy, (ii) the fact that revenues are not growing in line with inflation and (iii) the skew towards re-current expenditure (employment costs).

Supplementary budget, Given the inflationary pressures, revenue collections to year end are now projected at ZW$1,7 trillion, while expenditures are now estimated at ZW$1,9 trillion.

This is against the approved Budget of ZW$968,3 billion, entailing additional spending of ZW$929 billion.

This is largely a reflection of inflationary pressures in the domestic economy. The bulk of the Supplementary Budget (53%) is going towards employment costs to cushion public servants against increasing cost of living.

The balance of the additional resources is going towards meeting government consumables (18%), capital projects (19%) and social benefits (7%).

Key revenue measures The minister of Finance and Economic Development proposed a platinum royalty rate of 5%, in line with other platinum producing countries in Africa, effective 1 January 2023. The royalty rate of 5% will also apply on lithium with effect from January 1 2023.

The Tax-Free Threshold on local currency remuneration was reviewed from ZW$300 000 to ZW$600,000 per annum and the tax bands adjusted to end at ZW$12 million from the current ZW$6 million per annum, above which tax will be levied at a rate of 40%, with effect from August 1 2022.

The local currency tax-free bonus threshold reviewed from ZW$100 000 to ZW$500 000, with effect from November 1 2022.

A Rebate of Duty on equipment for use in scientific research imported by institutions approved by ministries responsible for Health, Mining, Agriculture and Higher and Tertiary Education introduced.

VAT registered operators now provided with the option to pay duty in foreign currency to facilitate offsetting of output and input tax in the same currency.

Current account Merchandise exports and imports increased by 33% and 15% to US$3,517 billion and US$3,747 billion respectively, during the first half of 2022, compared to the same period in 2021.

Exports are expected to reach US$7,3 billion in 2023, spurred by increases in mineral receipts benefitting from the mineral commodity price boom, as well as increases in agriculture and manufactured exports.

On the other hand, merchandise imports are also projected to reach US$8,1 billion driven by fuel, machinery, and raw material imports.

Overall, the country’s balance of payments remains favourable with a current surplus of US$387,1 million having been registered during the first half of 2022.

The positive current account performance is envisaged to continue for the remainder of the year to close at US$366,3 million on the back of strong export performance and resilient remittance inflows.

The debt overhang Public and publicly guaranteed debt currently stands at ZW$1,3 trillion and US$13,153 billion comprised of domestic and external debt, respectively.

Such high public debt relative to GDP affects Zimbabwe’s international financial credibility and hence its ability to unlock credit and investment.

In addition, it has a negative effect of crowding-out resources from the private sector. The government has however developed the Arrears Clearance, Debt Relief and Restructuring (ACDRR) Strategy aimed at restoring debt sustainability and has started token payments to creditors to re-engage international financiers.

Zimbabwe’s creditors, include the World Bank, AfDB, European Investment Bank and other multilateral and bilateral lenders.

That said the predicament is that the country is failing to unlock external funding to support local production, mainly because of the debt overhang.

Inflation developments

Global tensions have caused major supply disruptions and led to historically higher prices for most commodities. The price of Brent crude oil is projected to average US$100/bbl in 2022, a 42% increase from 2021 and its highest level since 2013.

Non-energy prices are expected to rise by about 20% in 2022, with the largest increases in commodities where Russia or Ukraine are key exporters.

Wheat prices are forecast to increase by more than 40% this year, reaching an all-time high in nominal terms.

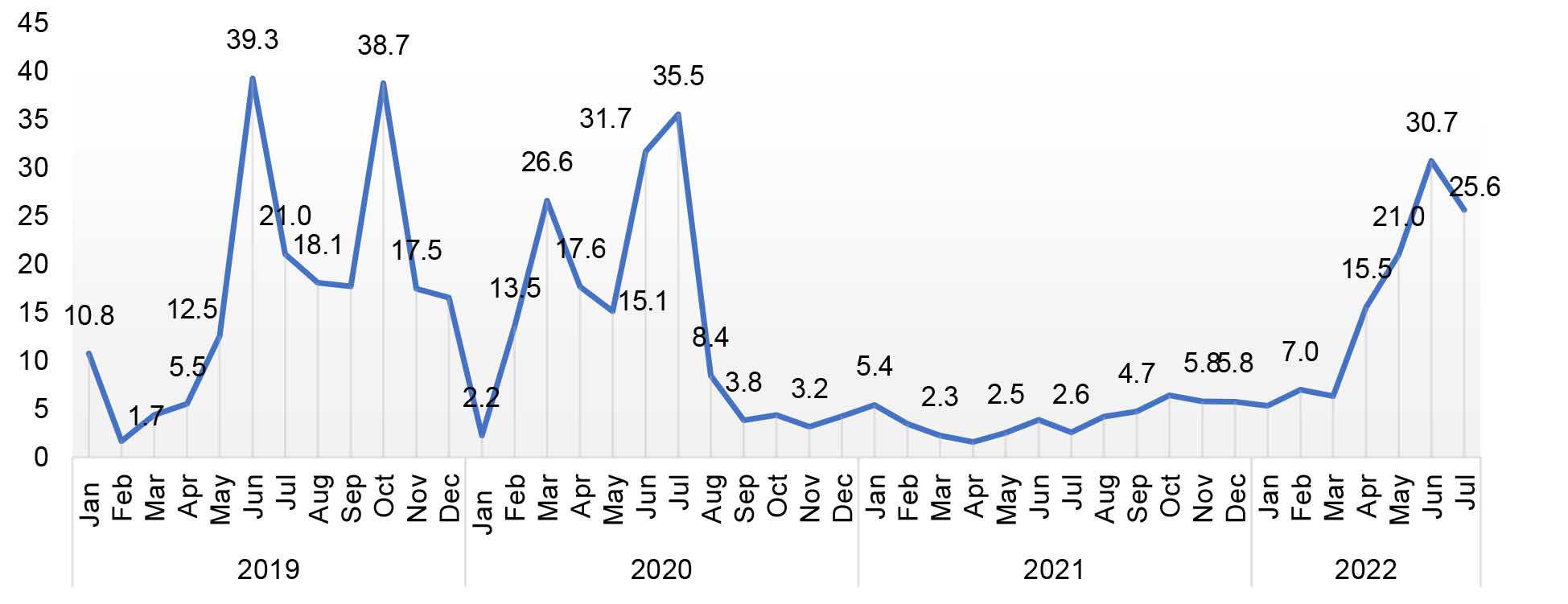

Domestic headline inflation steadily accelerated from 60,7% in January to 257% in July 2022, partly due to external factors which impacted negatively on import prices of raw materials, food, fertilisers, and liquid fuels.

Domestic adverse inflationary pressures through forward pricing and sustained depreciation of the exchange rate were additional drivers of inflation.

Downside risks to inflation and exchange rate stability going forward include:

Continued geo-political tensions that are driving the surge in international food and oil prices (imported inflation);

Growth in broad money driven by excessive liquidity held by banks despite reserve money being targeted at 0%;

Adverse inflation expectations;

Speculative tendencies; and

Continued arbitrage in the economy.

Inflation and exchange rate forecasts

Morgan & Co Research maintains a strong view that Zimbabwe will witness foreign inflation spill overs throughout 2022 given that the country is largely import-dependent.

A sharp increase in international food and oil prices has started to feed into domestic consumer prices.

Price level risks also remain elevated in 2023, bearing in mind that there could be unplanned government expenditures as the country moves into electioneering mode.

Political interests will always take centre stage, and this could lead to budget overruns.

We therefore envision a deteriorating exchange rate on the back of an increase in money supply. We also note that the following conditions that point to waning confidence in the local unit (ZWL) as set out by the International Accounting Standard (IAS 29) Financial Reporting in Hyperinflationary Economies remain prevalent in the domestic economy;

The general population prefers to keep its wealth in non-monetary assets or in a relatively stable foreign currency. Amounts of local currency held are immediately invested to maintain purchasing power;

The general population regards monetary amounts not in terms of the local currency but in terms of a relatively stable foreign currency. Prices may be quoted in that currency; Sales and purchases on credit take place at prices that compensate for the expected loss of purchasing power during the credit period, even if the period is short;

Interest rates, wages and prices are linked to a price index; and

The cumulative inflation rate over three years approaches, or exceeds, 100%

We have modelled inflation using a simple linear regression.

This is a statistical method that involves the study of the relationships between two continuous (quantitative) variables.As part of our research, we have carried out a scenario analysis to come up with estimates for inflation and the exchange rate. This is the average scenario, based on the assumption that M3 (Money Supply Growth-MoM) will grow at a monthly average of 16,32% up to December 2023.

In this scenario, inflation peaks to 475,7% in March 2023 and settles at 290,2% in December 2023. The parallel market exchange rate forecast for December 2023 is ZW$2,269/USD

The worst-case scenario considers the most serious or severe outcome that may happen on the monetary front in Zimbabwe. This could take the form of:

Geo-political risk pass-throughs;

Unplanned government expenditures; and Oil price shocks.

The assumption is that M3 (Money Supply) will grow at a monthly average of 23,07% up to December 2023.

In this scenario, inflation peaks to 702,8% in April 2023 and settles at 529,3% in December 2023. The best-case scenario is the most ideal projected scenario. However, it requires serious efforts on the part of monetary authorities and is also linked to acceleration of economic reforms.

The advancement of key reforms may result in re-allocating spending to more productive uses; reducing spending inefficiencies and distortions; and ensuring monetary policy supports price and exchange rate stability.

The assumption is that M3 (Money Supply) will grow at a monthly average of 5,38% up to December 2023.

In this scenario, inflation trends down gradually and settles at 51,6% in December 2023. The parallel market exchange rate forecast for December 2023 is ZW$1,290/USD.

Based on our assessments of geopolitical risks as well as country-specific issues, there is a stronger probability for the Worst-Case Scenario to play out (assigned probability of 55%).

While we note some positive developments in the form of improved foreign exchange receipts and the mopping up of excess liquidity through gold coins, global inflation risks remain elevated.

The upcoming elections are also a big factor given that they could trigger excessive government expenditures. Therefore, we expect inflation to reach 529,3% and the exchange rate to deteriorate to ZW$2,873/USD by December 2023.

Introduction of gold coins The Reserve Bank of Zimbabwe recently introduced gold coins into the market as a store of value. The gold coins (Mosi-Oa-Tunya) weigh one troy ounce with purity of 22 carats. Other features of the coin include liquid and prescribed asset status.

The gold coins are available for sale to the public in both local currency (ZWL) and United States dollars (USD) (and other foreign currencies) at a price based on the prevailing international price of gold and the cost of production.

The Reserve Bank of Zimbabwe (RBZ) recently announced that 1,500 gold coins were sold by its agents during the first week of their release onto the market, signalling a strong demand for the yellow metal.

A total of 85% of the sales were in local currency while the balance of 15% was bought in foreign currency. The RBZ released a total of 2,000 Mosi-oa-Tunya gold coins on the July 25 2022 and indicated that it will be releasing another batch of 2 000 soon. The gold coins were sold at an initial price of US$1,823.80 per coin.

Zimbabwe is not the first country to introduce gold coins. According to the Gold Bars Worldwide, countries with gold coins include South Africa with its Krugerrand gold coins, Australia has Australian Kangaroo, the United States has the American Eagle, Canada has the Maple Leaf and Austria has the Vienna Philharmonic.

Krugerrands, for example were first minted by the Republic of South Africa in 1967 to help promote South African gold to the international markets and to make it possible for individuals to own gold. Krugerrands are among the most frequently traded gold coins in the world market

There has indeed been a significant global shift to gold amongst Central Banks. According to the World Gold Council, central banks around the world are increasing the gold they hold in foreign exchange reserves, as they have built up their gold reserves by more than 4 500 tonnes over the past decade.

The value of the US dollar against gold has also dropped sharply over the last decade as large-scale monetary relaxation has kept boosting the supply of US dollars.

According to S&P Global, gold prices have been supported by multidecade-high inflation rates in many developed countries. In addition, US real yields have remained in negative territory because of low nominal interest rates which supports the case for gold investment. The gold price outlook for the short term is expected to fluctuate around USD1,900/oz due to the current geopolitical and macroeconomic uncertainties. As interest rates rise, prices are expected to average around USD1,825/oz by late 2022 before ending a five-year forecast horizon closer to USD1,700/oz.

Impact on investment markets The Mosi-Oa-Tunya Gold Coin should be seen as an alternative investment to USD, the stock market and properties market. Generally, a gold coin is amongst the most preferred choices of investment. It is a low-risk investment option that offers better security. Gold is also a tangible asset and has always commanded a good market value for centuries. Some of the benefits of investing in gold coins are as follows;

Gold is a safe-haven asset. Global investors typically look at gold as a haven during times of political and economic uncertainty. History is full of collapsing empires, political coups, and the collapse of currencies. During such times, investors who held gold were able to successfully protect their wealth.

Gold is a good hedge against inflation. Gold is an alternative to currencies, particularly where the native currency loses its value. Gold is a real physical asset that tends to hold its value in the market.

No maintenance is required. Unlike other tangible assets, investors in gold coins do not need to worry about its maintenance to get the best returns.

Gold is a diversifying investment. Gold can add a diversifying component to investment portfolios. Gold prices are not directly correlated to stocks, bonds and real estate.

Gold is easily transferable. Once bought, gold coins can be easily passed on to generations. This is what has been traditionally happening within families.

Inflationary pressures and the instability of the local currency unit clearly cement the investment case in the Mosi-Oa-Tunya Gold Coin. In addition, there has been a lot of interest in the coins (particularly from a ZWL position) given that it has prescribed asset status.

According to the Ministry of Finance and Economic Development, the persistent low level of compliance with the prescribed assets threshold by the insurance and pension industry remains a cause of concern.

Going forward, the industry will need to invest in bankable projects that can be accorded prescribed asset status or subscribe to Government paper to comply with the law.

The gold coin has therefore triggered a massive sell-off on the Zimbabwe Stock Exchange (ZSE) as institutional investors are switching to an alternative asset-class. As a result, the stock market has largely de-rated on weak demand because of tight liquidity in the market.

Morgan & Co is a securities firm.