Innscor Africa, currently the second largest counter by market capitalisation on the Victoria Falls Stock Exchange (VFEX), with a market weight of 24%, released its half year financial results for the six months ending 31 December 2024.

The blue chip counter reported a revenue increase of 12% from US$480 million to US$536 million, largely attributed to strong volume growth concentrated in the Mill-Bake, Beverage and Light Manufacturing segments.

Since a surge in revenue is largely driven by either price increase or volumes increase, Innscor chose the latter to avoid passing on the cost to consumers, leveraging on its economies of scale, regardless of the cost impact of regulatory adjustments to the VAT status on many of its key product lines, coupled with the Special Surtax on Sugar Content (Sugar Tax). Let us look at the business model of the group to come up with meaningful analysis:

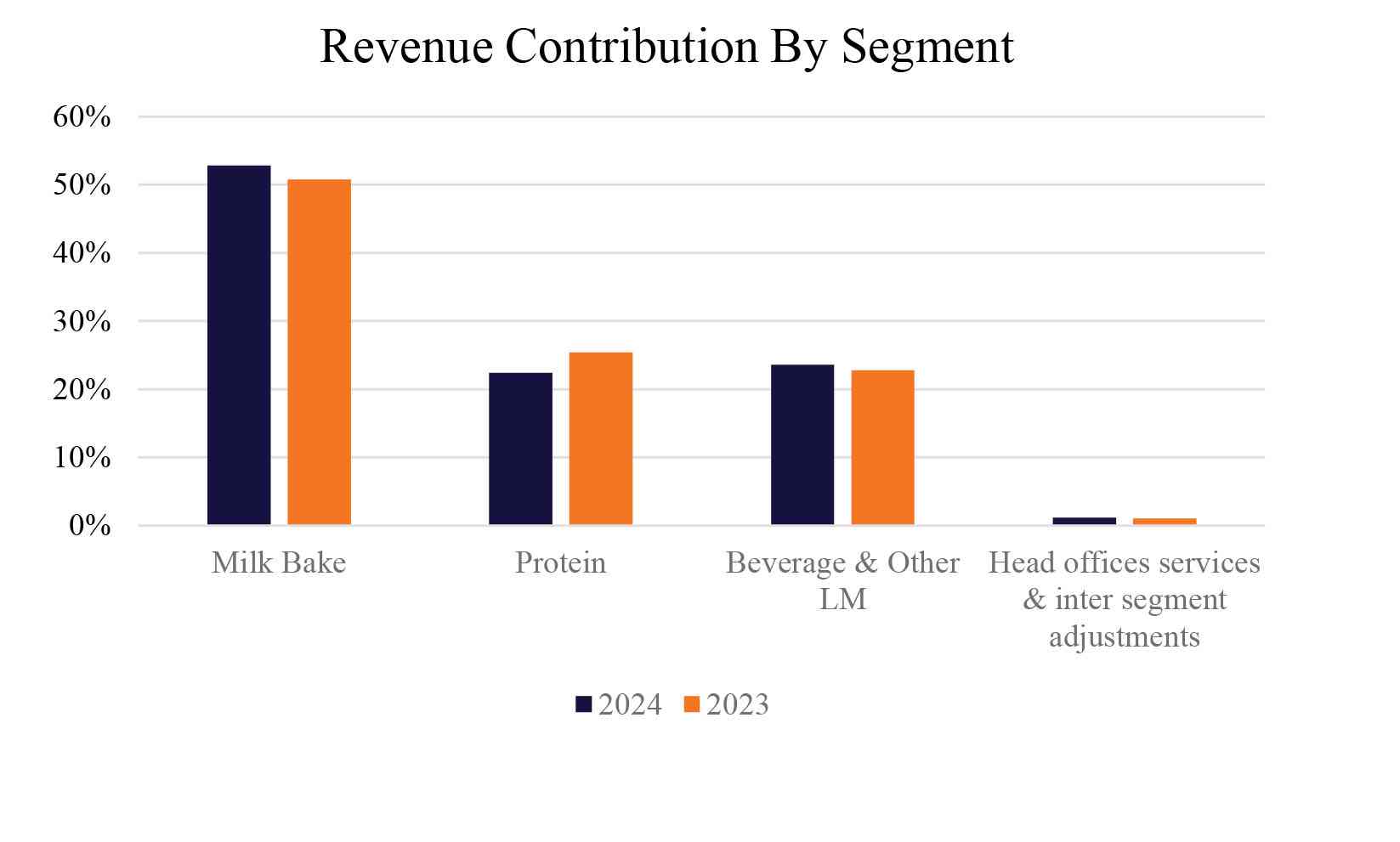

Innscor Africa has three main segments: Mill-Bake, Protein, and Beverages & Other Light Manufacturing segments.

The Mill-Bake segment, which includes Bakeries division, National Foods, Profeeds, and Nutrimaster, is the largest contributor to the group's overall revenue currently constituting a share of 52,8% from 50,8% in the same comparable period for the 2024 financial year.

Under the Mill Bake segment, the only division that faced headwinds is Profeeds, where the Harare-based factory operation incurred a material silo collapse in November 2023, rendering one of its two production lines inoperable since the event. As a result, overall volumes declined by 5% over the comparative period.

The Protein segment comprises of its Colcom division, Irvine’s Zimbabwe, and Associate Meat Packers Group.

This segment faced challenges at Colcom.

- Pension funds generate US$29 million

- Caledonia to restart key Bilboes operation

- Simbisa Brands mulls VFEX listing

- Simbisa Brands listing boost for VFEX

Keep Reading

The change in VAT status on pork products from “exempt” to “standard-rated”, created an unequal level playing field between formal operators and informal operators.

Irvines Zimbabwe registered a positive 11% volumes growth, but AMP Group had mixed performance.

The beef category recorded 24% surge in volumes whilst the chicken category recorded a 15% slip in volumes.

The protein segment contributed 22,4% to the top line for the six months period ending 31 December 2024, compared to 25,4% of the same period in the prior year.

The Beverages & Other Light manufacturing segment comprises Mafuro Farming, Prodairy, Probottlers, The Buffalo Brewing Company (TBBC) famously known for producing Nyathi sorghum beer, Natpak, as well as the group’s non-controlling interest in Probrands.

This is the segment that was subject to effects of sugar tax on its Probottlers division.

Other divisions in this segment recorded positive surging volumes except for Probottlers where aggregate volumes closed 4% behind the comparative period.

The cordials operating under “Bally House” and CSD operating under “Fizzi” drinks were both affected by Sugar tax, which had the effect of increasing costs to consumers of a considerable number of product lines and suppressing demand.

If we are to juxtapose and look at Delta Corporation, it was also affected in its Sparkling Beverages volumes for the half year ending 30 September 2024 for the same reasons.

However, Innscor seems to have gained a competitive advantage with the Nyathi beer because TBBC recorded positive volumes at a time when Delta’s Sorghum beer volumes declined across its key markets in its half year period.

Now, let’s do away with operational performance and look into the numbers, shall we?

While top line performance was robust, profitability margins came under pressure.

Operating profit before finance costs, depreciation, amortisation, and fair value adjustments (EBITDA pre-fair value) saw a marginal improvement in margin to 10,98% from 10,57%, which depicts that operating costs increased over the period but at a slower pace compared to revenue. However, the combined EBITDA and fair value adjustments margin eased slightly to 11%, down from 11,2% in the prior period.

Similarly, the EBIT, equity-accounted earnings, and fair value adjustments margin contracted by 0,43 percentage points to 7,9%, while the profit before tax margin declined by 0,07 percentage points to 8,3%.

These margins reflect the group's efforts to absorb regulatory cost impacts while sustaining volume growth and market share.

Following a three-year Capex drive, depreciation expenses also became a major cost item.

From a balance sheet perspective, total assets increased by 11%, with property, plant and equipment constituting 47% of the total assets. Total equity also increased by 6%.

Comparing this growth in assets and equity to the marginal growth in the bottom line of only 1%, Return on Assets (ROA) declined to 4,1% from 4,5% and Return on Equity also declined to 7% from 7,4% recorded for the half year in the 2024 financial year.

Perhaps a breather for long-term investors comes from the business’ ability to generate sufficient cash flows for continuous growth. Considering Innscor’ s improving operational efficiency, solid growth prospects, and strategic positioning, it presents a compelling investment opportunity for long-term investors.

- Taimo is an investment analyst with a talent for writing about equities and addressing topical issues in local capital markets. He holds a First Class Degree in Finance and Banking from the University of Zimbabwe. He is an active member of the Investment Professionals of Zimbabwe community, pursuing the Chartered Financial Analyst charter designation.