OVER the past two decades, the importance of access to financial systems has gained significant momentum, sparking widespread interest among policymakers, economists, and governments globally.

There is a growing consensus that financial inclusion plays a vital role in reducing poverty and fostering economic growth.

African countries have made significant progress in financial development and financial inclusion over the last two decades. In spite of this progress, there is still a considerable need for further development.

Notably, the United Nations 2030 Agenda for Sustainable Development recognises financial inclusion as a crucial component in achieving the Sustainable Development Goals (SDGs), particularly in reducing inequality (SDG 10).

This acknowledgment underscores the significance of financial inclusion in promoting economic development and social equality.

As the world strives to achieve the SDGs, financial inclusion has become an increasingly important factor in bridging the economic divide and promoting sustainable development.

By expanding access to financial services, individuals and communities can break the cycle of poverty, build resilience, and improve their overall well-being.

Mobile money services act as a dependable driving force of digital financial inclusion, agents of social transformation, and interventions in the economy to influence access to financial services and means for social protection. Consequently, the absence of access to financial resources in other parts of the world affects 1,4 billion unbanked individuals worldwide, revealing a significant gap in financial inclusion within developing economies.

- Young entrepreneur dreams big

- Chibuku NeShamwari holds onto ethos of culture

- Health talk: Be wary of measles, its a deadly disease

- Macheso, Dhewa inspired me: Chinembiri

Keep Reading

Furthermore, the multi-dimensional nature of financial technology (fintech) encompasses everything from digital payments, mobile banking, cryptocurrencies to complex blockchain networks that house encrypted transactions, leading to new opportunities for financial inclusion and financial literacy.

Driven by the need for accessible and efficient financial services, the fintech sector has leveraged digital platforms to bridge this gap. Therefore, demand for contactless payments, online banking, and digital credit solutions has surged exponentially, accelerating fintech technology adoption.

Notably, regions with limited traditional financial infrastructures have witnessed significant fintech growth, providing citizens with a secure alternative for transactions and financial management.

The expansion of mobile money systems is creating new opportunities for small and medium enterprises (SMEs), particularly in low-income countries in the global south, to access financial services.

Subsequently, mobile banking enables the transfer and receipt of small amounts of money in real-time at low costs. While fintechs appear to be a new set of technological breakthroughs, the basic concept has been around for some time.

The first credit cards from the 1950s generally represent the first fintech products that were available to the public, eliminating the need for consumers to carry physical money with them in their daily lives.

Over the years, fintechs have grown and changed in response to developments within the broader technology sector. Consequently, digital banking is easier than ever, and consumers are managing their money, applying for and paying off loans, and purchasing insurance through digital banks.

However, this lack of financial access poses a substantial hurdle, particularly for citizens and micro-entrepreneurs, who drive economic development, create employment opportunities, and enhance community living standards.

Efficient financial transactions are crucial in these economies, and fintech platforms play a vital role in enhancing productivity by enabling secure and swift fund disbursements to multiple beneficiaries.

Nevertheless, robust business processes are essential to safeguard against malware, payment errors, and fraudulent activities.

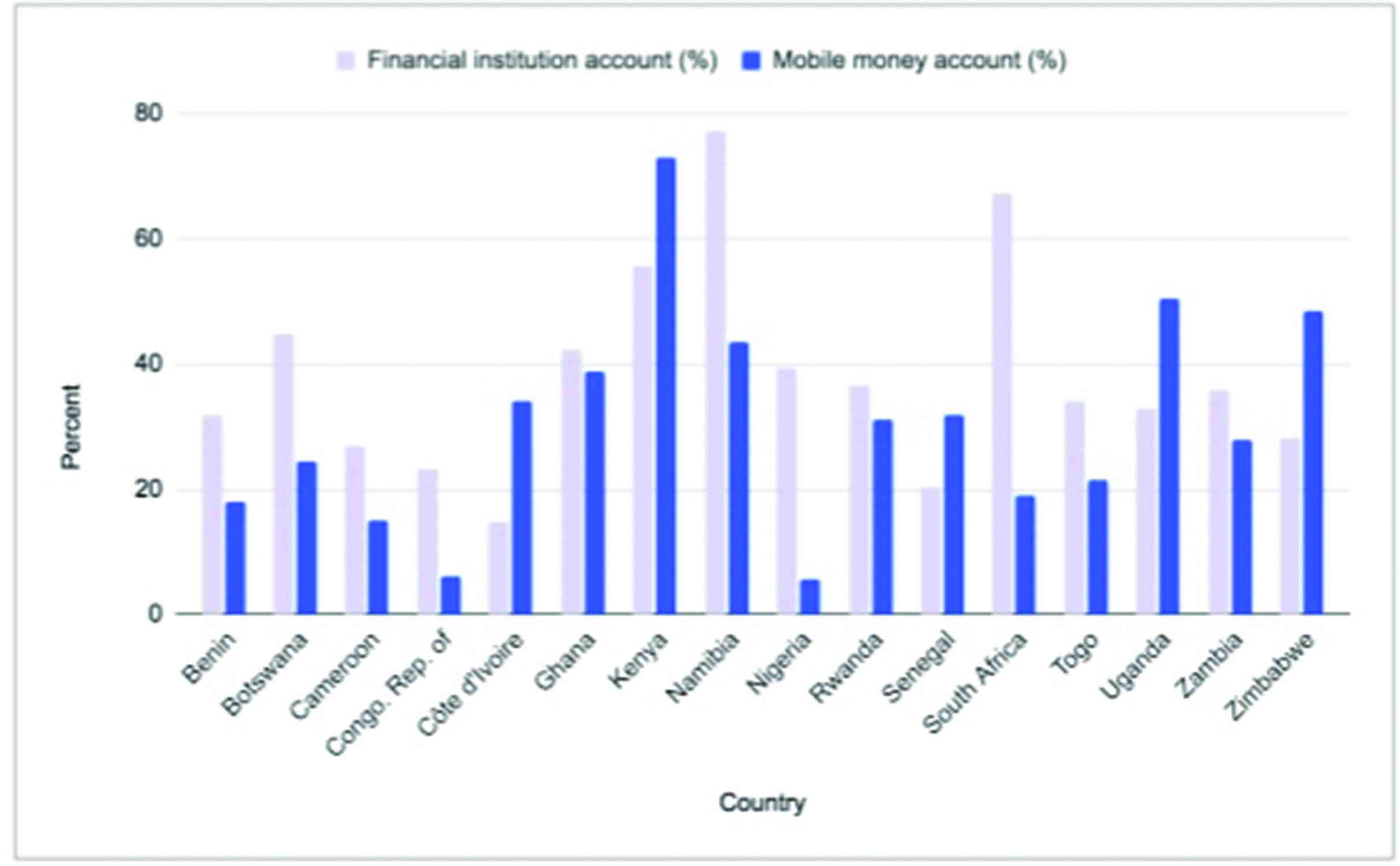

Across the continent, mobile payment services have skyrocketed as indicated above, even outpacing the number of people, who have access to traditional banks.

Certainly, fintechs transform the lives of many through financial inclusion, but it is also about doing things smarter and cheaper. By leveraging fintech innovations, small and medium enterprises can access better financial services, fostering job creation and improved livelihoods.

However, the lack of infrastructure, particularly access to energy and affordable internet, remains a significant bottleneck to scaling up these innovations.

Fintech evolution has remodelled the manner we do business, buying stocks, and accessing financial advice. The Reserve Bank of Zimbabwe’s National Financial Inclusion Strategy 2022-2026 aims to expand the fintech ecosystem, incorporating the unbanked population and promoting financial inclusion.

There are many different fintech companies in Zimbabwe that offer exclusive services to their clients, including Paynow, Ecocash, Zimswitch, Instapay, Mukuru, Bitmari, and Innbucks.

While Mukuru has recently introduced a digital wallet, designed with the informal economy in mind, offering a lifeline to those excluded from traditional banking, underscoring the potential of fintech innovations to promote financial inclusion and economic growth. However, some regions have been excluded in financial inclusion notably provinces such as Matabeleland North (60%), Mashonaland Central (58%), and Matabeleland South (53%) exhibit the highest rates of exclusion.

These areas are predominantly rural, with limited access to essential services such as healthcare, education, and economic opportunities, which contributes to elevated exclusion levels. Consequently, the lack of access to these services exacerbates the challenges faced by rural communities.

In contrast, urban centres such as Harare (17%) and Bulawayo (20%) report the lowest exclusion rates, likely due to improved access to resources and services commonly found in urban settings.

This disparity underscores the contrast between rural and urban regions, with rural provinces experiencing greater challenges related to exclusion, influenced by factors such as geographical isolation and underdeveloped infrastructure (Japhet Mutale and Darold Shumba, 2024). Therefore, addressing these challenges is crucial to promoting financial inclusion and reducing exclusion in rural areas.

Moreover, in Zimbabwe, fintechs have largely been driven by a range of factors, including the macro-economic situation, cash shortages, and the advent of the Covid-19 pandemic, which intensified the pace of digitalisation of financial services.

These services promise far-reaching societal benefits, such as social security and protection, and the potential to contribute to much better financial inclusion, leading to socio-economic transformation.

Anchored more on inclusion of previously disadvantaged groups, worldwide, almost a quarter of adults do not have access to a basic bank account due to high service costs, lack of access and trust with banks, and distance to a financial institution and difficulties in obtaining identity documents.

Lack of access to formal savings or loan instruments exacerbates poverty, since the ability to save, borrow, and exchange money is the key to escaping poverty.

Thus, cash transfers, loans, and saving schemes interventions improve access to poverty alleviation reduction, nutritional outcomes, and spreading of household safety nets.

As the future of any economy depends on the uptake of new technologies and access to these technologies by consumers, collaboration between regulators, fintech companies, major industries, and the public and private sectors, is crucial to maximise benefits and foster an environment conducive to growth and financial inclusion.

In summation the democratisation of financial services can enable a greater proportion of the population to manage their finances effectively.

To promote financial inclusion, several key factors need to be considered. These include enhancing cybersecurity measures to safeguard digital financial services, introducing digital loan access platforms, and integrating group schemes to encourage community savings.

Other key factors to consider are addressing financial illiteracy through education and training, promoting technological innovation, developing infrastructure in rural and marginalised areas, and fostering cooperation among banks to share resources and reduce costs.

- Nyawo is a development practitioner, writer and public speaker. These weekly articles are coordinated by Lovemore Kadenge, an independent consultant, managing consultant of Zawale Consultants (Pvt) Limited, past president of the Zimbabwe Economics Society and past president of the Chartered Governance & Accountancy Institute in Zimbabwe. — [email protected] or mobile: +263 772 382 852.