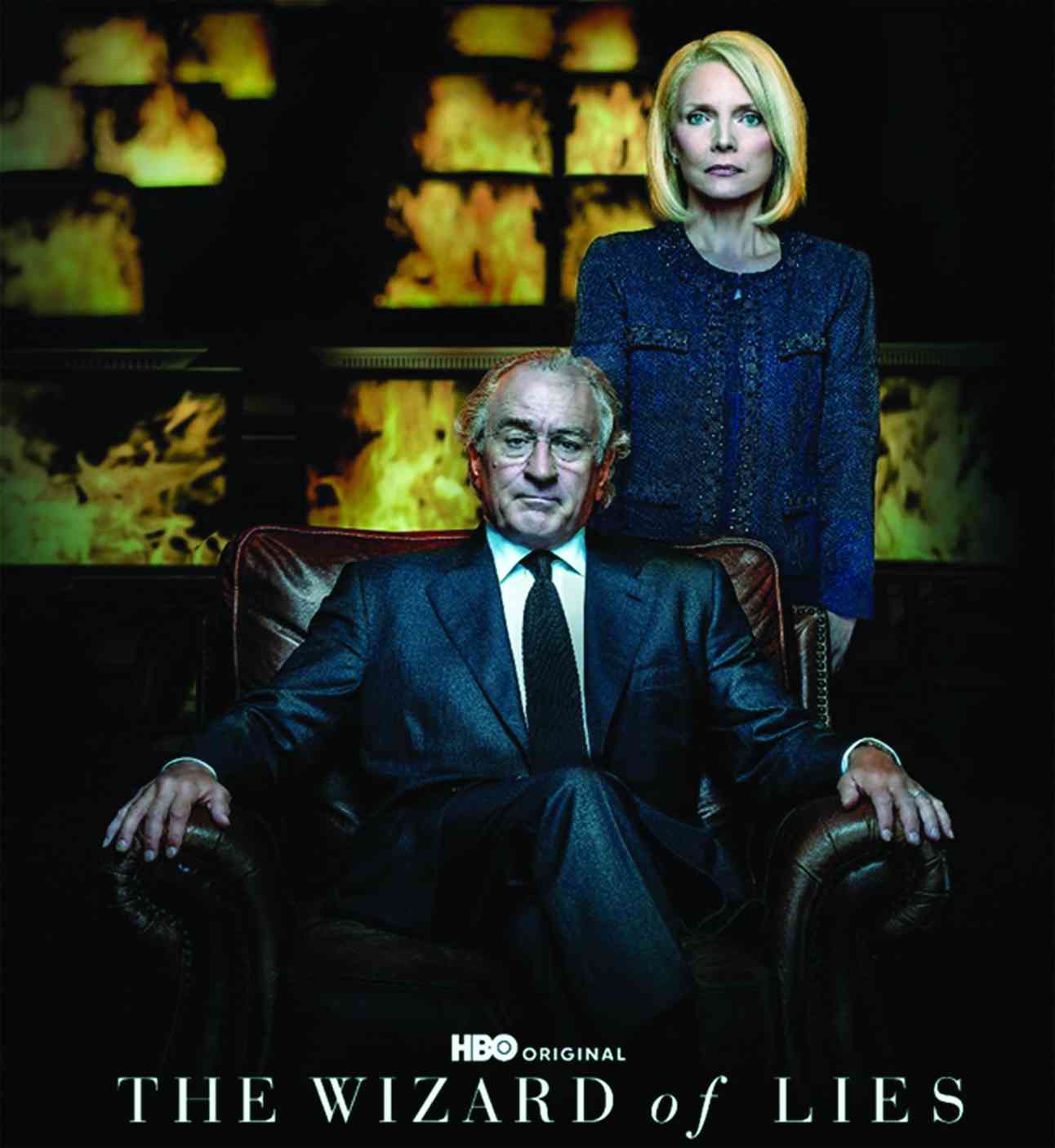

BASED on New York Times journalist Diane Henriques’s account of the Madoff affair, The Wizard of Lies is a psychologically simplistic tragedy about Bernie’s impact on his immediate family, particularly wife Ruth (Michelle Pfeiffer), and sons Mark and Andrew (Alessandro Nivola and Nathan Darrow).

Bernard “Bernie” Madoff was an American financier who executed the largest Ponzi scheme in history.

Madoff claimed to generate large, steady returns through a genuine investing strategy but simply deposited client funds into a single bank account that he used to pay existing clients who wanted to cash out.

He funded redemptions by attracting new investors, but was unable to maintain the fraud when the market turned sharply lower in late 2008.

The Securities Exchange Commission (Sec) valued the total loss to investors to be around US$65 billion. Madoff was also described as “the modern face of financial evil” given that his personal and business asset freeze created a chain reaction throughout the business and philanthropic community. This forced many organisations to at least temporarily close, including the Robert I Lappin Charitable Foundation, the Picower Foundation and the JEHT Foundation.

In 2009, Madoff was sentenced to 150 years in prison and forced to forfeit US$170 billion.

‘The Wizard of Lies’

Madoff managed to cultivate an image of exclusivity and often turned clients away.

- Piggy’s Trading & Investing Tips: The huge advice gap

- Use REITs as buffer against inflation: Mthuli

- SecZim creates a financially savvy generation

- SecZim bemoans absence of investment bankers

Keep Reading

This model allowed roughly 50% of Madoff’s investors to cash out at a profit.

He also offered consistent and above average returns of 10 to 20% per annum. He was a “master marketer” who, throughout the 1970s and 1980s, built a reputation as a wealth manager for a highly exclusive clientele.

What allowed Madoff to steal as much as he did for as long as he did simply was due to who he was and what he represented.

Madoff marketed himself as a co-founder of Nasdaq and had served as its chairperson; he was a prominent New York philanthropist and a member of numerous industry and private boards committees.

Because of this reputation, no one wanted to believe Madoff was running a lie. Not even the government.

Through his brand name and his guise, he was able to dupe not only investors, but some of the best and the brightest. Interestingly, it is also reported that Madoff utilised his religion to take advantage of his fellow Jewish people.

The ability to find a certain group to target allowed the scheme to commence and grow. Based on research, Piggy has come up with the following indicators that can help one to identify Ponzi schemes and avoid such scams:

- Exceptional profits with minimal risk: The initial warning sign of a Ponzi scheme is the assurance of exceptional profits with minimal or no risk. A genuine investment typically correlates high returns with increased risk.

- Steady profits: Ponzi schemes frequently yield steady profits, irrespective of market conditions. This occurs because the returns are sourced not from actual investments but from the capital of new investors.

- Intricacy and concealment: Ponzi schemes often encompass intricate and covert investment strategies that are difficult to comprehend. This is deliberately done to bewilder investors and deter them from probing further.

- Unregulated investments: Numerous Ponzi schemes involve unsanctioned investments or unauthorised sellers. These investments might not be subject to regulatory scrutiny, complicating the process of verifying their legitimacy.

- Aggressive sales techniques: Ponzi scheme perpetrators often employ aggressive sales techniques to persuade investors to participate in the scheme promptly. They might establish a sense of urgency by asserting that the investment opportunity is exclusive or time-sensitive.

- Obstacles in receiving payments: A telling sign of a Ponzi scheme is when investors face difficulties in receiving payments or withdrawing funds. Ponzi schemes typically collapse when there are insufficient new investors to pay returns to earlier investors.

- Dependence on new investors: Ponzi schemes rely on a continuous influx of new investors to remain operational. If an investment opportunity emphasises heavily on attracting new investors, it might be a warning sign. Although many legitimate investments encourage referrals, a Ponzi scheme often offers financial rewards to existing investors for recruiting new members.

- Evasive leadership: If the leadership team behind an investment opportunity is evasive, unresponsive, or unreachable, it might signify a Ponzi scheme. Genuine investment opportunities typically feature leadership teams that are approachable and transparent regarding their operations.

- Unsupported or exaggerated claims: Perpetrators of Ponzi schemes often make unsupported or exaggerated claims about the investment opportunity or the company’s performance. These claims might include unrealistic revenue projections, false endorsements, or baseless success stories.

In conclusion, the structure of a Ponzi scheme is founded on deception, fabricated promises, and a continuous flow of new investors.

Some institutions, households and individuals can channel hard-earned money to unfit “investment vehicles” such as Ponzi schemes and gambling activities because of a lack of understanding of investment markets.

There is a need to focus on improving financial literacy levels within the general populace and increasing the participation of locals in regulated investment markets.

For more insights, be part of the fastest growing network of trading and investing enthusiasts by joining a PiggyNetwork WhatsApp group on +263 783 584 745.

- Matsika is the creator of the PiggyNetwork. — +263 783 584 745 or [email protected]