INFLATION statistics released by the Zimbabwe National Statistics Agency (ZimStat) for January 2025 nearly went unnoticed, yet they offer unparalleled insights into the complex economic dynamics currently at play in Zimbabwe.

Zimbabwe faces a formidable economic force sweeping across all sectors, driven by rampant informalisation that exploits policy gaps, many of which stem from government design.

This shift is eroding traditional businesses while depriving the Treasury of much-needed tax revenues, leaving a trail of economic instability.

The inflation data for January presents a compelling case, revealing early industry responses to the 2025 national budget.

As the first full month under the newly-implemented fiscal policies, January 2025 offers crucial insights into how businesses are adjusting to the evolving economic landscape.

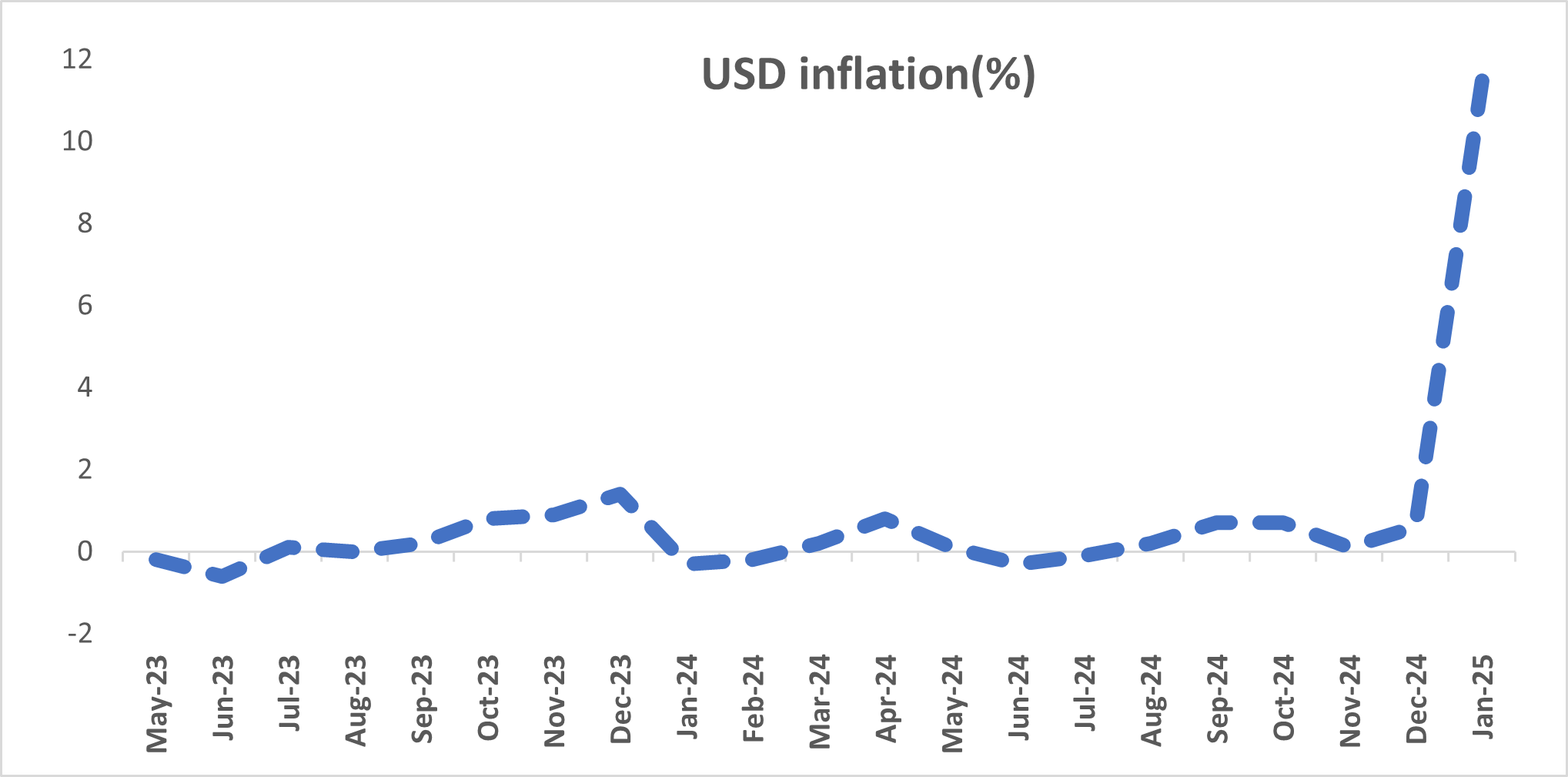

The data by ZimStat showed that annual inflation measured in United States dollars (USD) came in at 11,5%.

This means prices of goods and services on average rose by 11,5% in USD in the month compared to the prior month outturn of just 0,6%.

Looking at the data, the aggregate in over 15 years has not recorded such a rise averaging less than 1%.

- Education crisis mirrors national problem

- Thousands flee economic mess

- ZimStat undertakes to pay enumerators

- 'Apostolic sects frustrating fight against measles'

Keep Reading

From May 2023 to December 2024, average inflation outturn in USD was 0,25%, showing how significant a rise of 11,5% is.

The USD inflation measure is considered the most stable one of the three inflation measures used by Zimbabwe.

In 2023, the country introduced the blended exchange rate, officially adopting it as the benchmark for currency valuation.

While USD-denominated prices have remained relatively stable — thanks to the currency’s inherent strength — the local unit has continued to depreciate against the US dollar.

Consequently, prices in Zimbabwean dollars (now ZiG) have exhibited significant volatility, fluctuating far more than USD-priced goods since the reintroduction of the local currency.

What caused the price surge in USD?

The rise in prices during January, even in a currency traditionally considered stable, signals deeper economic pressures at play.

Businesses have already priced in the significant tax increases introduced in the 2025 budget, passing these costs onto consumers.

This is evident in the price hikes seen even in USD-denominated goods, underscoring the far-reaching impact of the new tax regime.

The 2025 national budget introduced a range of new taxes, largely targeting the informal sector and its supply chains.

These additional costs have created significant hurdles for businesses, making it increasingly difficult to import goods or source supplies from manufacturers to retailers.

Over the years, the informal sector has developed a complex and well-honed distribution network that undercuts wholesalers and side-lines traditional retailers, posing viability challenges, particularly in the formal retail sector.

The inflation outturn, showing a 11,5% growth in prices in USD in January, simply reflects on the transfer of costs by those affected by the taxes to the final consumer.

In response, the government has intensified its clampdown on informal trade through a multi-agency task force launched in late 2025.

So far, the task force has seized goods worth under US$3 million, a disheartening outcome, considering the tax revenue losses run into tens of millions.

Meanwhile, smuggling remains rampant, particularly at Beitbridge, where goods worth millions of dollars enter the country daily through illicit channels. The lack of willpower to address these fundamental economic distortions is evident.

At the core of this crisis is the entrenched political patronage system. The biggest beneficiaries of the smuggling networks at Beitbridge are politically-connected individuals, with influence extending across all sectors.

Within Zimbabwe, the tuckshop cartels, which dominate the retail landscape, are controlled either directly by these political figures or by their proxies, who in turn offer political protection in exchange for loyalty.

This culture of impunity is not confined to retail alone; it also permeates mining, the country’s economic lifeline.

They would rather see the country go down on its knees again than to change the status quo. A lot has been written, including in this publication, on what needs to be done to change policy driving formalisation and returning sanity to the economy.

In Zimbabwe’s gold-rich belts, particularly in the Midlands, powerful political figures control small-scale mining operations (Makomba).

These individuals dictate sponsorship terms, extract hefty commissions, and channel proceeds to higher political offices. Such unchecked power allows them to arbitrarily seize or reallocate mining claims, often rewarding close political associates.

The consequences have been devastating, rampant gold smuggling, underinvestment in mining, and a reliance on crude, hazardous mining techniques that endanger both miners’ lives and the environment.

This is the harsh reality of Zimbabwe’s present-day economy. Companies scaling back, restructuring, or shutting down are not failing due to mismanagement, they are simply unable to survive in an environment riddled with distortions and systemic inefficiencies.

A deeply-flawed policy framework has placed the formal sector at a disadvantage, limiting its ability to respond swiftly to economic shocks such as currency volatility.

However, history has shown that resilient businesses can adapt and emerge stronger. Retailers such as OK Zimbabwe, which weathered the 2008 economic collapse, cannot simply be dismissed. In that period, former OK CEO Willard Zireva was even jailed by the former president Robert Mugabe administration for refusing to comply with price controls. Yet, within a few years, OK Zimbabwe attracted high-quality investors, became one of the top-performing stocks on the Zimbabwe Stock Exchange (ZSE), and delivered strong financial results.

To navigate today’s crisis, the corporate sector must take a unified stance on regulation, policy interpretation, and policy impact.

A year ago, CBZ Holdings’ new CEO hailed the introduction of the ZiG, claiming it had brought much-needed stability — yet, in reality, that stability was artificial.

A pegged currency cannot be considered stable when a parallel market remains strong enough to destabilise it.

Many industry players initially embraced the ZiG, yet today, they are implementing drastic cost-cutting measures, some of which stem from a lack of foresight in assessing policy risks. At this stage, the informalisation wave cannot simply be halted, especially given the flawed strategies deployed to fight it. A lasting solution requires fiscal stability, but not through excessive taxation that punishes businesses and consumers.

Instead, the government must restore fiscal discipline, ensuring monetary policy independence to curb the reckless money-printing practices that have historically fuelled inflation and currency depreciation.

Only once fiscal stability is restored can Zimbabwe achieve true currency stability, reducing rent-seeking behaviour and arbitrage opportunities.

Additionally, regulatory frameworks, both in the business environment and capital markets, must be recalibrated to rebuild a formalised, structured economy that fosters sustainable growth rather than entrenching economic distortions.

Equity Axis is a financial media firm offering business intelligence, economic and equity research. The article was first published in its latest weekly newsletter, The Axis.