THE Zimbabwe Stock Exchange (ZSE) and the Victoria Falls Stock Exchange (VFEX) began the year with market capitalisations of approximately US$1,67 billion and US$1,28 billion, respectively.

This was primarily driven by a sharp decline in equity values on the ZSE, as a result of a liquidity crunch since trading on this bourse is conducted in Zimbabwean Gold (ZiG).

Given the high levels of informality, it is unsurprising that most institutions and individuals prefer using the United States dollar for daily transactions, as well as for precautionary and speculative purposes, rather than investing it in the VFEX, which offers limited speculative opportunities.

With the month of January now behind us, it is time to review the month’s performance and analyse our local capital markets. Let us dive in and share our insights, shall we?

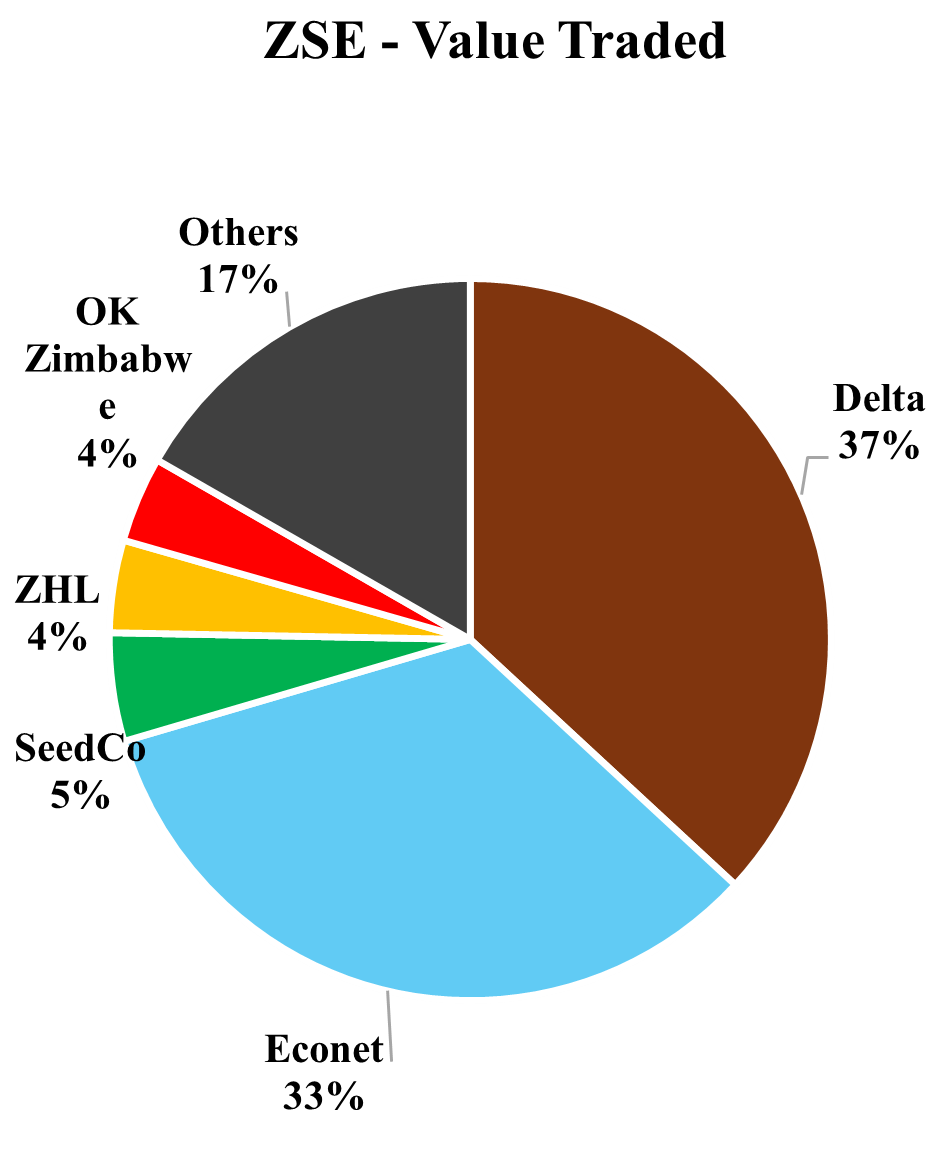

In January, the ZSE saw an 11% drop in market capitalisation, following a 18% decline in December 2024. Monthly turnover reached ZiG200 million, with Delta contributing ZiG74 million and Econet adding ZiG67 million.

This marked a decrease from December’s turnover of ZiG225 million, which was driven by Delta (ZiG101 million) and Econet (ZiG53 million).

On the VFEX, market capitalisation dipped by 1%, and turnover declined by 41% to US$11,6 million from US$19,6 million recorded in December 2024.

January’s turnover was primarily fuelled by Natfoods buybacks totalling US$9,2 million, while December’s activity was driven by Simbisa (US$10 million) and Innscor (US$6,5 million) trades on December 5.

- Inaugural Zim investor indaba highlights

- Stop clinging to decaying state firms

- ZB explores options to tackle inflation

- Zim operations drive FMB Capital

Keep Reading

On the Zimbabwe Stock Exchange (ZSE), among the top five counters with the highest market turnover, only ZHL posted gains of 44%.

Delta declined by 7%, Econet dropped by 22%, Seed Co fell by 29%, and OK Zimbabwe lost 43% of its value.

The decline in these blue-chip stocks, which carry significant market weight, contributed to the ZSE, closing the month in negative territory.

Delta Corporation and Econet Wireless released their third-quarter trading updates. Delta’s sparkling beverages and sorghum segments faced challenges due to stiff competition and climate-related issues, impacting volumes.

Econet, on the other hand, delivered a strong performance, with a 20% increase in voice usage and a 36% rise in data usage, despite Starlink’s entry into the Zimbabwean market.

Despite a contrast in these updates, both counters recorded losses throughout the month, which, in my view, are not reflective of their fundamentals but rather the on-going liquidity crunch in the market.

Similarly, the decline in Seed Co’s value does not align with its fundamentals, as the counter was already heavily affected last year by the El Niño-induced drought.

Given the anticipated improvement in the agricultural sector this year compared to 2024, Seed Co should ideally be on an upward trajectory.

Among the top five, OK Zimbabwe appears to be the only counter whose price movement reflects its fundamentals, as it struggles with competition from the informal sector.

The company has been closing some of its branches, a trend likely to continue due to the dominance of the US dollar and the reduced use of the local currency.

On the Victoria Falls Stock Exchange (VFEX), activity remained relatively flat, with Natfoods’ once-off trade driving the month’s turnover.

A 1% decline in market capitalisation on this foreign denominated bourse further underscores the reduced liquidity on the bourse, as net sellers continue to offload shares at a loss to raise operational liquidity.

Having reviewed the key developments on both exchanges, what can we expect moving forward?

Will the ZSE’s downward trend persist throughout February?

If so, when might the market begin to recover?

In my opinion, equities remain under significant pressure due to the liquidity crunch, leaving many major counters undervalued and trading below their historical averages.

However, the likelihood of further declines is diminishing, as share prices for many key counters are already near all-time lows compared to their historical averages. This presents compelling buying opportunities for investors targeting quality blue-chip stocks.

That said, the timing of a potential uptrend remains uncertain, as any recovery will largely depend on improved liquidity in the market.

- As on January 31 the official rate was US$1:ZiG23,6 and on December 31, it stood at US$1:ZiG24,83.

Taimo is an investment analyst with a talent for writing about equities and addressing topical issues in local capital markets. He holds a First Class Degree in Finance and Banking from the University of Zimbabwe. He is an active member of the Investment Professionals of Zimbabwe community, pursuing the Chartered Financial Analyst charter designation.