IN the 2024 proposed national budget, a sugar tax was introduced for beverage manufacturers. Initially set at US$0,002 per gram, the tax was revised downward to US$0,001 per gram in February 2024 following objections from beverage manufacturers.

From February to December 2024, the total sugar tax collected amounted to US$31,2 million, covering both sparkling beverages and cordials produced by Delta.

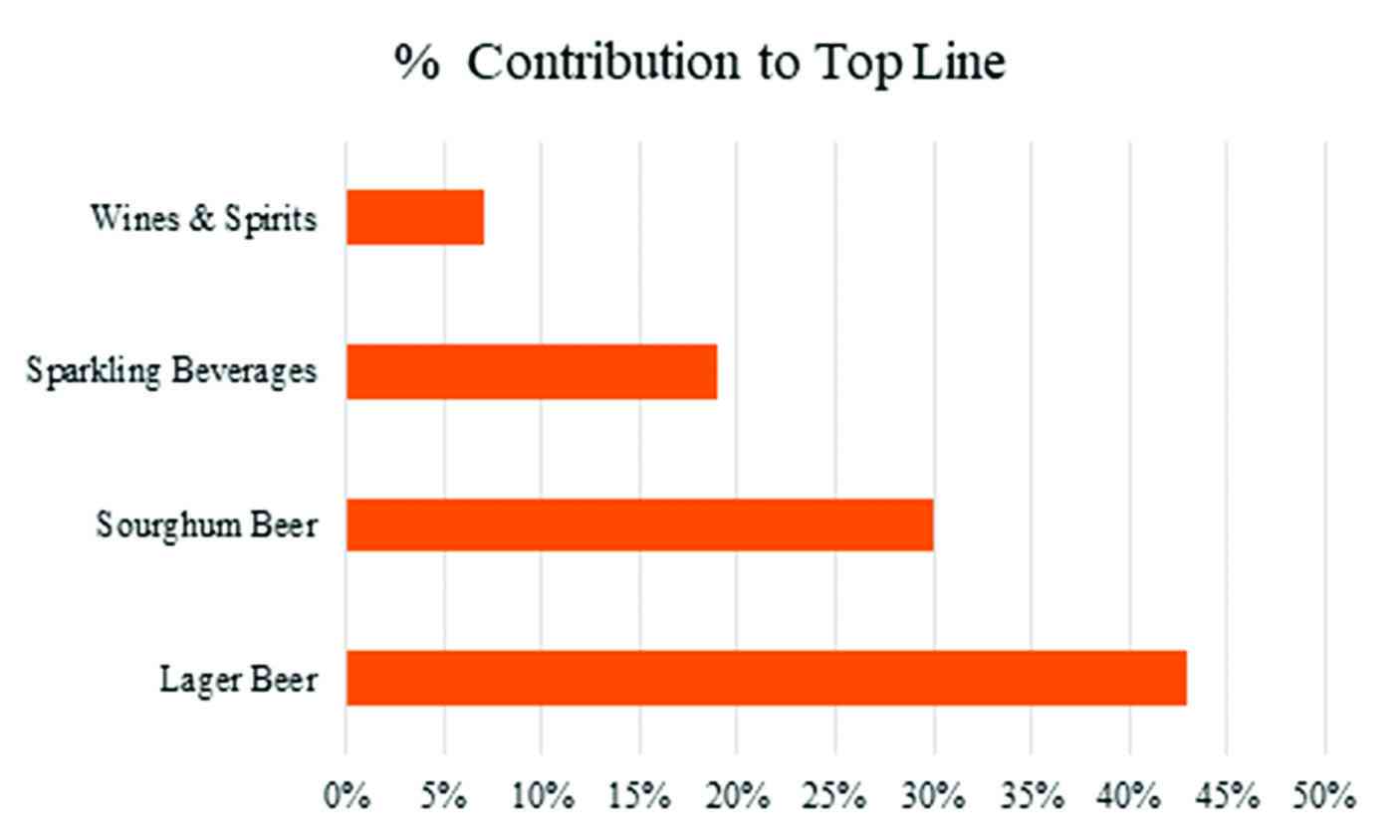

Based on the previous full-year revenue and operating expenses (Opex), this figure accounts for 4% of Delta's top-line revenue and 5% of its Opex.

Delta Corporation Limited reported a 1% increase in revenue for the third quarter ending on December 31, 2024, compared to the same period in 2023.

Additionally, the company recorded a 7% revenue growth for the nine-month period ending December 31, 2024, compared to the same period the previous year.

Of the four major revenue drivers, only two showed positive volume growth for both the third quarter and the nine-month period. These were the lager beer segment and wines and spirits under its subsidiary, African Distillers (Afdis).

Lager beer volumes grew by 4% for the quarter and 7% for the nine-month period compared to the prior year. Afdis recorded impressive volume growth of 14% for the quarter and 12% for the nine months period.

In contrast, sparkling beverage volumes declined by 16% for the quarter and 1% over the nine-month period. Sorghum beer volumes also saw declines, dropping by 8% for the quarter and 10% for the nine-month period.

- Environmentalist in12 000km protest ride

- Chibuku NeShamwari holds onto ethos of culture

- Chibuku NeShamwari holds onto ethos of culture

- Health talk: Covid-19: Zim should brace for fifth wave

Keep Reading

Now, let us delve into the segmental performance and revenue growth for both the third quarter and the nine-month period to analyse what these numbers entails.

For context, Delta is the largest listed company on the Zimbabwe Stock Exchange (ZSE) by market capitalisation, attracting significant attention from local analysts.

Its analyst briefings are among the most attended events in Zimbabwe’s capital markets.

Currently, Delta accounts for 30% of the total ZSE market capitalisation and contributes over 50% of the average daily traded value on the local exchange.

Lager beer volumes on the rise

Throughout the reporting period, supply faced challenges due to prolonged water and power outages.

Despite these obstacles, the brands maintained strong market presence through sponsorships of sports and arts events, including the Castle Lager Braai Day, Carling Black Label DJ Clash, the Castle Lager Premier Soccer League, and other brand-driven initiatives.

This resilience has positioned the lager segment as the top performer in both volume growth and revenue contribution. Given this momentum, the segment is expected to sustain its upward trajectory and play a key role in keeping the business robust and resilient.

Wines and spirits volumes soar

The wines and spirits segment under Afdis faced intense competition in previous years from cheaper, illicit alcohol smuggled into the country.

In response, the subsidiary actively engaged with the government, leading to the current crackdown on illicit and smuggled alcohol to address unfair competition.

The ready-to-drink and wine segments, which recorded growth of 12% and 47% respectively, benefited from improved product supply and a reduction in informal imports.

The sustainability of this strong performance largely depends on the continued crackdown on illicit alcohol and enhancements in market distribution channels. However, it remains the smallest contributor to the overall top line.

Sorghum beer slips

Overall, volume declined by 8% for the quarter and 10% for the nine-month period, primarily due to the halt in exports.

The sorghum beer category faced several challenges, including the drought, reduced disposable incomes in rural areas, changes in distribution channels and inconsistent performance by retail and wholesale partners.

The sector also saw new entrants and the return of established players.

As this segment is the second-largest contributor to the group’s top line, the volume decline is concerning. In my view, it is crucial for the group to maintain buffer stocks to mitigate the effects of climate change and to reassess its strategy to better compete with the growing popularity of the Nyathi brand.

Sparkling beverages

The volume decline in this segment can be attributed to the combination of price increases driven by the sugar tax and a surge in imports from the region.

It is reasonable to attribute part of the volume loss to the intense competition from companies such as Varun Beverages, which offer cheaper soft drinks compared to Delta’s.

The revenue growth in this segment has primarily come from price hikes in response to the sugar tax, rather than volume increases and this is not sustainable for the long-term health of the business.

In response, the group has already begun plans to reformulate its soft drinks to eliminate sugar while retaining the same taste, aiming to gain a competitive edge.

With the recent reduction in the sugar tax to US$0,0005 per gram, we will see if the volume loss was truly driven by the sugar tax.

In my view, the beverage manufacturer needs to closely monitor the competition from Varun and ensure their cordials and soft drinks are competitively priced, as the market appears to be increasingly saturated with products from this competitor, while Delta’s presence seems less dominant.

Taimo is an investment analyst with a talent for writing about equities and addressing topical issues in local capital markets. He is an active member of the Investment Professionals of Zimbabwe community, pursuing the Chartered Financial Analyst charter designation