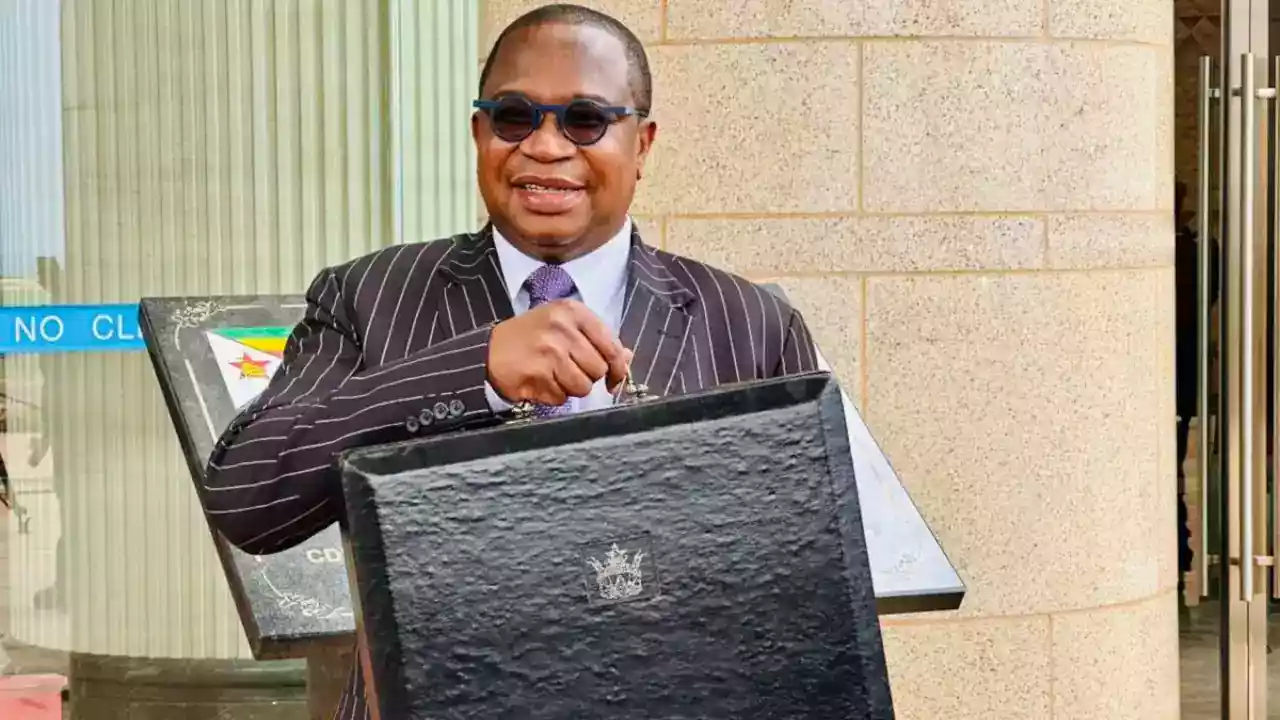

IN late November, Finance, Economic Development and Investment Promotion minister Mthuli Ncube unveiled Zimbabwe's 2025 national budget, which outlines planned expenditures of ZiG276 billion and projected revenues of ZWG 270 billion.

For many, these figures still seem abstract, making it challenging to make some sense out of them. To provide clarity, converting these amounts into United States dollars gives a clearer picture: depending on whether the parallel market or interbank exchange rate is used, total expenditure translates to between US$7 billion and US$10 billion, with a projected budget deficit of only between US$100 million and US$300 million.

Economic analysts have debated the practicality of the budget, particularly since over 80% of the projected revenue is expected to come from taxes.

Consequently, scepticism was expressed regarding the government's ability to realistically collect over US$7 billion in taxes, with many citing it as an ambitious target.

New tax measures promulgated include a 0,5% levy on fast foods like pizza, burgers, and fried chicken, a 25% tax on rental income from residential properties converted for commercial use, a 20% plastic carrier bag tax aimed at environmental sustainability, a 10% withholding tax on sports betting winnings, and a requirement for income tax registration for loans exceeding US$20 000 or applications for mining rights.

The repeal of Section 22 of the Sovereign Wealth Fund Act has partially addressed some of these lingering questions, leaving analysts pondering the broader implications of this policy shift.

This essentially means that authorities are now permitted to use state enterprises managed under the Mutapa Investment Fund (MIF) as collateral for loans.

Drawing from my extensive background in lending, I was compelled to delve into the implications of this decision.If the government defaults on these loans, lenders could seize the state enterprises offered as collateral.

- Village Rhapsody: How Zimbabwe can improve governance

- Defaulting Zim in bid to pacify Paris Club . . .US$420.4m black hole exposed

- Fidelity loans, IMF windfall to give Zim mines a big lift

- I am not scared: AfDb chief shrugs off Africa food crisis

Keep Reading

In effect, this move could be interpreted as the government indirectly selling off some of its state-owned assets. Why? Because the nation is already burdened with a debt overhang exceeding US$21 billion, which has remained largely unserviced for years.

Any new loans secured against these assets would only add to this national debt, significantly increasing the risk of defaults.

Let us take a closer look at the assets under the MIF. As of October 2024, statistics released by MIF chief executive officer John Mangudya estimated the total assets under the fund to be valued at US$16 billion.

This figure stands in stark contrast to the nation’s debt of US$21 billion, as previously mentioned. Meanwhile, the 2025 national budget allocated only about 8% — approximately US$520 million —towards debt restructuring.

The critical questions then, revolve around the amount of money the government intends to borrow using MIF assets as collateral and the specific purposes of these loans.

In terms of the 5 C’s of credit, collateral appears to be the only factor left supporting the government’s creditworthiness.

However, if these loans are directed toward non-income-generating activities, we could find ourselves in a never-ending cycle of debt.

Another school of thought could also suggest that the government aims to dispose or privatise some of its enterprises.

If this is the case, it might be a noble move for certain entities, such as Zesa if only executed properly.

For instance, despite ongoing efforts to rehabilitate Hwange Units 7 and 8, persistent power blackouts continue to affect a significant portion of productive sectors, imposing substantial burdens on major industries.

Even some blue-chip companies listed on the local stock exchanges are incurring high operating costs resulting from reliance on diesel generators to mitigate the impact of power outages.

From the standpoint of an ordinary citizen, privatisation could be beneficial as taxes could be redirected to other areas of need since new shareholders would assume responsibility for ensuring that the enterprise delivers essential services to customers, of course in a profitable manner.

Here are some of the benefits to consider:

- The government can access funds at a lower interest rate, reducing the cost of borrowing.

- The pledged assets can be used to secure loans for critical infrastructure projects or social programmes.

- This approach can help the government to diversify its funding sources and reduce dependence on traditional borrowing methods.

- Here are the risks involved:

- The government is putting its assets at risk, which could lead to losses if the loans are not repaid.

- The pledged assets may be undervalued or overvalued, which could affect the government's financial position.

- This approach may create a moral hazard, where the government is more likely to take on excessive debt, knowing that its assets are being used as collateral.

Do you think the benefits outweigh the demerits or not?

In my opinion, if the government decides to proceed with securing these loans, it must conduct thorough due diligence to ensure the accurate valuation of pledged assets and refrain from using the funds for non-income-generating activities, especially given the ongoing struggle to service the existing debt of over US$21 billion.

- Taimo is an investment analyst with a talent for writing about equities and addressing topical issues in local capital markets. He holds a First Class Degree in Finance and Banking from the University of Zimbabwe. He is an active member of the Investment Professionals of Zimbabwe community, pursuing the Chartered Financial Analyst charter designation.