In early April 2024, the Reserve Bank of Zimbabwe (RBZ) introduced a new structured currency, the Zimbabwe Gold (ZiG), to tame increased exchange rate fluctuations driving local prices haywire. This introduction was a crucial step needed for stabilizing the economy. Since then, a plethora of fiscal and monetary policy actions have been taken to support the local unit. As such, this column seeks to review the general state of the economy in June 2024 to gauge the effectiveness of these policies implemented to date.

Economic outlook

In June 2024, authorities revised the 2024 economic growth forecasts by 1.5 percentage points to 2% from 3.5% initially projected through the approved national budget. The revisions consider the significant and urgent downside impacts of the El Nino-induced drought on the economy that authorities had initially underestimated.

This drought has led to a decline of roughly 70% in staple maize production in the 2023/24 season, a vital component of the agricultural sector. This sector remains the backbone of Zimbabwe’s economy, contributing approximately 17% to national output (GDP), providing about 60% of industrial raw materials, and sustaining employment and income to 60-70% of the population.

Furthermore, the significant reduction in dam water levels due to climatic shocks has severely curtailed hydroelectricity production. The World Bank estimates that the prolonged power cuts will cost Zimbabwe about 6% of its GDP. In addition, the excessive volatility of the Zimbabwe dollar (ZWL) in the first quarter of 2024 has significantly hampered economic activity.

Similarly, the sudden switch to the new currency, ZiG, while necessary, has partly disrupted market transactions, particularly in the transport sector, underscoring the urgent need for stability. Other risks on the economic horizon include the rapid increase in dollarization, the rise of the informal economy, debt distress, rent-seeking behaviors, widespread corruption, high levels of illicit financial flows, and the deteriorating global geopolitical situation.

Despite the tightening outlook, authorities must maintain sound fiscal and liquidity management to protect the gains—currency and price stability—achieved so far. History is the best teacher. The nation enjoyed months of stability when the currency auction system was introduced in June 2020. However, this trend was short-lived as monetary growth started to grow unsustainably.

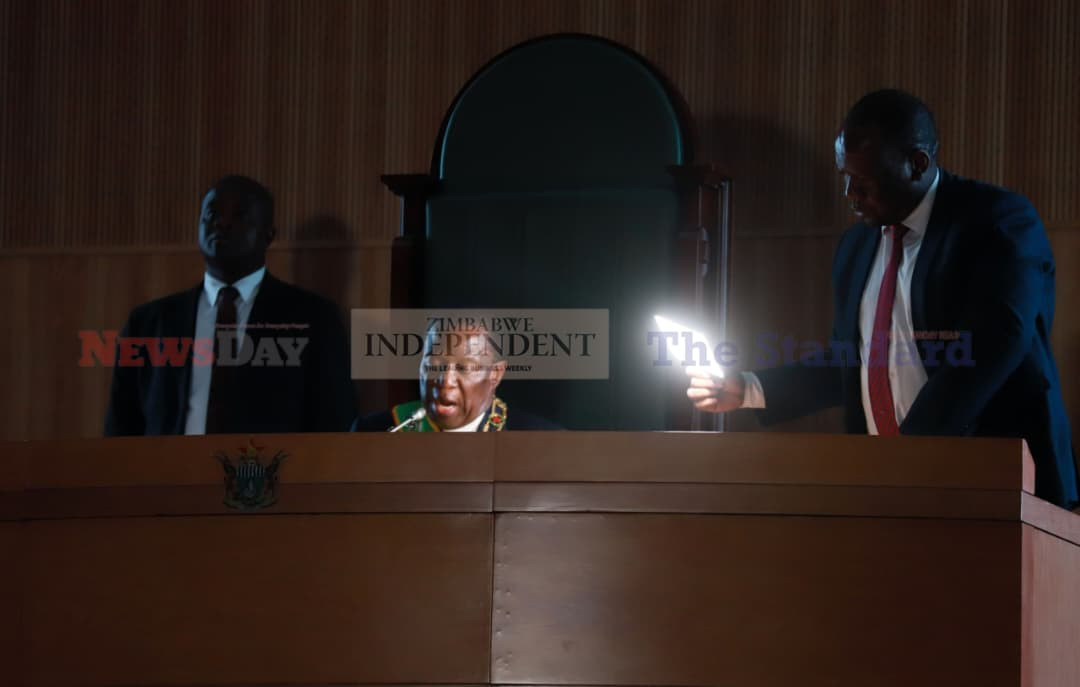

The new RBZ Governor, Dr John Mushayavanhu, is on record for not allowing money printing willy-nilly. Hopefully, there will be adequate political will to quench money printing pressure amid an economic outlook characterized by a balance of risks tilted to the downside.

- RBZ blocks Harare US dollar charges

- Industry cries foul over new export surrender requirements

- One stitch in time saves nine

- Banks keep NPLs in safe territory

Keep Reading

Inflation

Official statistics published by the Zimbabwe National Statistics Agency (ZimStat) revealed that the month-on-month (MoM) ZiG inflation rate for June 2024 was 0%. This means that prices, as measured by the all-items ZiG Consumer Price Index (CPI), remained constant between May 2024 and June 2024. With ZiG prices in formal markets being directly linked to the official exchange rate, the marginal loss of ZiG value against the USD experienced in June 2024 has not immensely impacted prices.

Overall, the ZiG's relative stability has significantly reduced fluctuations in local currency prices compared to the pre-ZiG period. If sustained, this relative stability will gradually help accumulate savings, stimulate private-sector investment, fuel consumer aggregate demand, and subdue extreme poverty.

This positive outlook, despite the potential downside risks, should instill a sense of optimism about the future of Zimbabwe's economy.

ZiG performance

The ZiG lost roughly 3% in official markets to close June 2024 at ZiG/USD 13.70 from ZiG/USD 13.32 at the end of May 2024. It has gained roughly 5% in the parallel markets to end the month at an average of ZiG/USD 17. ZiG's resilience in foreign exchange markets has collapsed the average parallel market exchange premium from roughly 50% in early May 2024 to about 20% at the end of June 2024. This is within the global benchmark for local currency stability

Fiscal and monetary authorities are implementing various policies to support the local unit. These include enforcing exchange rate regulations, improving inflation data transparency, and tight liquidity management, as recently alluded to by the International Monetary Fund (IMF). They are also disclosing (though partially) the quantum and location of reserves, encouraging MDAs to accept ZiG for public services, and settling part of customs duty and corporate taxes in ZiG, among other initiatives.

This concerted effort should reassure economic agents about the government’s commitment to maintaining ZiG stability. Nevertheless, authorities must urgently address the prevailing risks to maintain ZiG stability in the outlook period.

These risks, as already highlighted, include, but are not limited to, burgeoning informality, upscaled budget-financed infrastructure spending, rapid dollarization, climatic shocks, rising public debt and debt servicing costs, subdued global mineral commodity prices, high perceived public corruption, and excessive rent-seeking.

Public debt situation

Zimbabwe’s public and publicly guaranteed (PPG) debt situation continues to deteriorate, with the latest revelations by authorities showing that debt stock has reached US$18 billion, up 1.7% from US$17.7 billion reported in the 2023 Public Debt Report.

Authorities have admitted before Parliament that total PPG debt stock will jump as it is undergoing debt validation & reconciliation. Expected additions include US$1.9 billion for recapitalizing the Mutapa Investment Fund (MIF) and US$1.2 billion assumed from RBZ.

l Read full story on www.theindependent.co.zw

Sibanda is an economic analyst and researcher. He writes in his personal capacity. — [email protected] or Twitter: @bravon96.

Consequently, debt and debt servicing costs will balloon, posing considerable risks to the stability of government finances. This will threaten ZiG's stability and provision of critical public services like education and healthcare, as more resources must be earmarked for debt servicing. The PPG debt is already in distress, as shown by ballooning arrears and penalties. About 74% and 81% of combined bilateral and multilateral debt are interest and principal arrears and penalties, respectively.

Debt unsustainability is blocking Zimbabwe’s access to concessionary sources of finance to fund infrastructure developmental programs. It also sustains the unsustainable extraction of natural resources through reliance on risky resource-backed loans (RBLs). Overall, it is challenging to stabilize local currency in a developing country if the debt levels are not kept under check.

Electricity

In the month under review, the nation experienced prolonged load-shedding schedules, averaging 12 hours daily in many areas nationwide. This is crippling the domestic industry and poor households who cannot afford alternatives. The prices of electricity substitutes such as liquified petroleum gas (LPG) and fuel (petrol/diesel) remain high, sustained by deteriorating global geopolitics and resultant global geoeconomic fragmentation. The power shortages will also likely exert a knock-on effect on winter wheat farming, causing temporary commercial and communications disruptions, traffic congestion, banking disruptions, and increasing security threats.

The electricity crisis is attributed to planned repairs and low water levels limiting production from Zimbabwe's main hydro plant in Kariba, repairs at the aged Hwange thermal power plant, and lower imports from neighboring countries. The Zambezi River Authority (ZRA) has estimated live-water levels at around 12.8% in early June 2024, compared to 29.1% in early June 2023.

For Zimbabwe, hydroelectricity is critical as it accounts for at least 15% of the total primary energy supply. It is commendable that the government seeks to intensify investments in solar power and grid expansion to address electricity woes bedeviling the nation. For instance, in June 2024, the Cabinet reportedly approved a 600 Mega Watts (MG) floating solar plant on Lake Kariba, with the first phase of 150MW expected in 2025 and 300MW in 2026.

Fuel

ZimStat data shows that in May 2024, Zimbabwe’s diesel imports were up 40.7% to US$93.1 million from US$66.2 million in April 2024. Cumulatively, the nation spent US$372.11 million on diesel imports in the first five (5) months of 2024, slightly up 2.5% from the level realized for the same period in 2023. In May 2024, petrol imports were US$45.4 million, a 21.7% jump from US$37.3 million achieved in April 2024. Between Jan-May 2024, about US$198 million was spent on petrol imports compared to US$167.4 million in the same period in 2023.

Domestic fuel pump prices have been declining. Effective 5 July 2024, diesel price per liter will be capped at US$1.62, slightly down from US$1.61 in June 2024, while petrol will be capped at US$1.59, the same as in June 2024. In year-to-date (YTD) terms, the July 2024 diesel price per liter is down 3.6% from US$1.68 recorded in December 2023, while the petrol price per liter is up 2.6% from US$1.57 published in December 2023.

The decline in domestic pump prices mimics global crude oil market developments. International oil demand growth continues to slow due to a muted economy and accelerated adoption of clean energy in advanced economies. Meanwhile, global oil supply is mounting after the Organization of Petroleum Exporting Countries and its allies (OPEC+) announced plans to unwind last year’s extra voluntary output cuts gradually. However, the reliance on expensive domestic ethanol for petrol blending, elevated statutory & shipping costs, and generally reduced competition in the domestic fuel sector are sustaining high fuel pump prices.

- Zviko is an economist writing in his own capacity. He can be contacted via email at [email protected]. You can also follow him on the X-platform: @bravon96