AS the global economy and business grapple to align with the Paris Climate Agreement, we have never been closer to overshooting our planetary boundaries.

Our only chance of halting irreversible damage is urgent and collaborative action. The worlds of business, finance, government, and society must partner to accelerate climate action.

With less than seven years to achieve the 2030 Sustainable Development Goals, there is a renewed urgency to examine global systems and balance human and business aspirations with the planet’s ability to sustain them.

As the world contends with the impacts of an evolving world, the new mandate for businesses and other institutions is to take the lead.

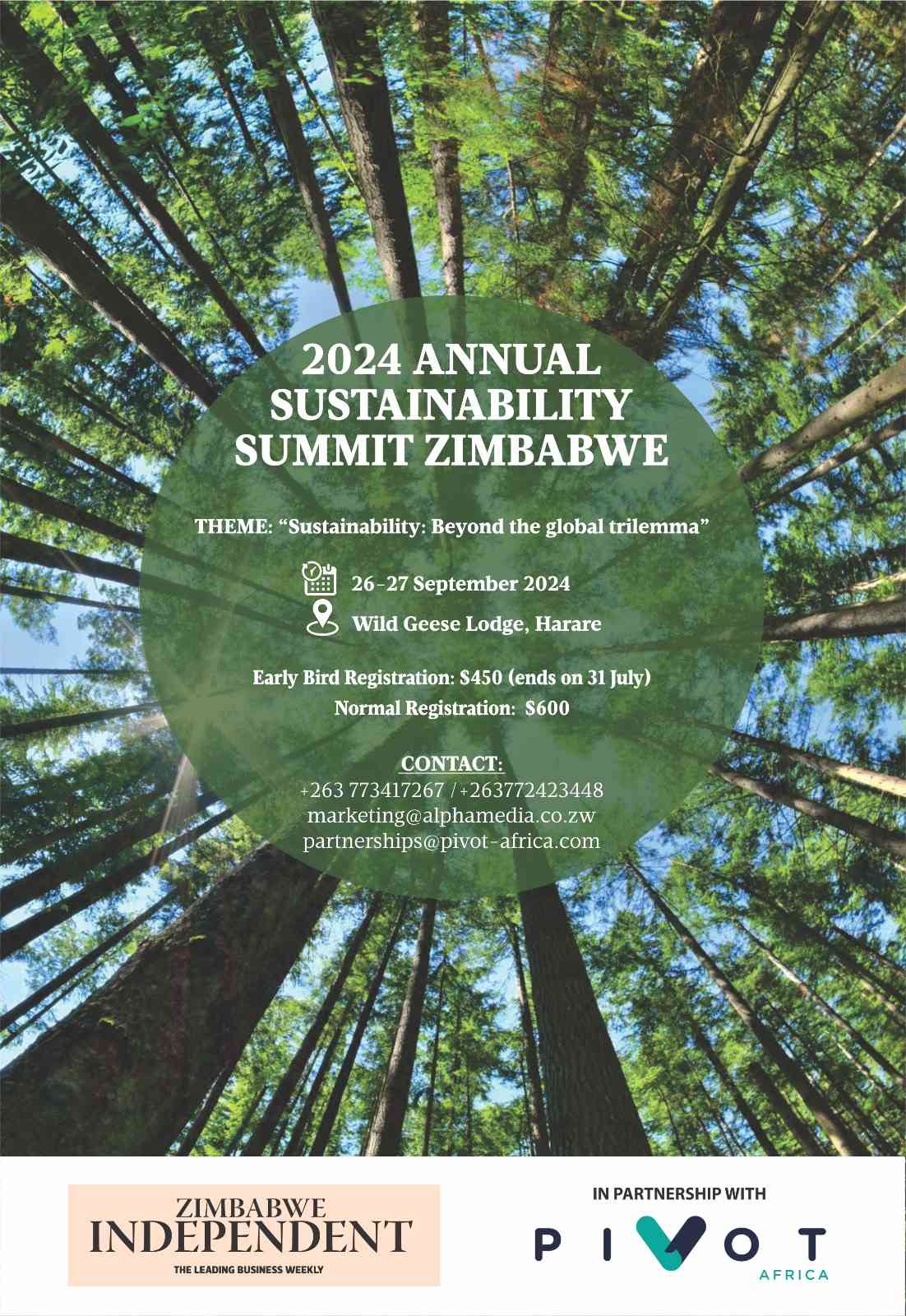

The Zimbabwe Independent in partnership with Pivot Africa will bring together stakeholders with a wealth of experience and different perspectives to discuss the big issues of the day at the 2024 Inaugural Annual Sustainability Summit.

Our aim is to convene and engage stakeholders, who have the power to bring real change. The 2024 Inaugural Annual Sustainability Summit Zimbabwe (Harare, September 26- 27, 2024), our premier sustainability meeting, is where future-defining partnerships will be forged. Corporate leaders will unite across key stakeholder groups to collectively shape the leadership strategies, investment frameworks and innovative technologies that will meaningfully address the triple planetary crisis.

Our flagship sustainability summit will be an unrivalled gathering where all four pillars of business, finance government and society will finally convene to drive meaningful change.

The summit will run under the theme Sustainability: Beyond the trilemma. The climate crisis, the rapid decline of biodiversity and nature and the energy crisis (triple crises-trilemma) has a significant impact on our world today and these are no longer just future threats but existential and it would be good to see actions match the rhetoric.

- COP26 a washout? Don’t lose hope – here’s why

- Out & about: Bright sheds light on Vic Falls Carnival

- COP26 a washout? Don’t lose hope – here’s why

- Out & about: Bright sheds light on Vic Falls Carnival

Keep Reading

Climate crisis

The earth’s climate has been changing throughout its history and researchers established that higher concentrations of greenhouse gases in the atmosphere will lead to higher global temperatures.

Human activity is by far the most likely source of excess greenhouse gas emissions. If this trend is ignored and we continue to do nothing, the global temperature will rise by around 5°C in a much shorter timeframe than we are prepared for.

The impact on the climate of this type of temperature increase is likely to change the physical geography of the earth, making some parts of the world inhospitable and will lead to more extreme weather events, destruction to the ecosystem, rising sea levels to mention a few.

It is clear that those responsible for the emissions are not necessarily those that will pay, and those that are at the sharp end of the adverse impact of climate change have not caused the damage.

Hence, human activity causes a negative externality. Identifying and addressing that externality is a key challenge for policymakers.

Climate change is a driver of risks and opportunities for businesses, it is critical to manage climate related risks and capture the opportunities associated with the transition towards low-carbon and climate-resilient economies.

Businesses need to understand the future costs associated with extreme climate change and the importance of collective efforts from governments, businesses, and individuals.

The future cost associated with extreme climate change is fast becoming a topic that policy-makers and sectors can no longer ignore.

Biodiversity and nature loss

Biodiversity is what keeps us all alive but has always been at the bottom of the list of economic priorities. Natural capital is the essence of all goods and services and it plays a pivotal role in all of our lives. In December 2022, history was made when governments and business came together to agree a global framework to halt and reverse accelerating nature loss.

A commitment was made to preserve 30% of land and the ocean by 2030. Yet the drive to achieve net zero will still require a six-fold increase in mineral extraction as well as a host of other emission intensive activities, putting increasing pressure on the very land, sea and air that is meant to be protected.

The World Economic Forum estimates that US$44 trillion of global gross domestic programme (GDP) is moderately dependent on nature. The Dutch Central Bank recently released a report that found out that 36% of the total assets of Dutch Financial Institutions, over €500 billion were lent or invested in sectors with high dependency on ecosystems.

This goes to show how the financial system is heavily dependent on nature and the services it provides us. Financial institutions are, therefore, exposed to reputational and transition risks if they finance companies that have major negative impacts on nature.

It is heartbreaking to see the extent and pace at which nature loss is happening and businesses today must adequately account for nature-related dependencies, impacts, risks and opportunities.

The full value or costs of destroying natural systems are not fully understood, for example, forests are highly connected systems. They are home to 80% of the world’s biodiversity.

They supply water, sequester carbon from the air, provide livelihoods to billions of people, among other benefits.

However, these positive externalities are not taken into account and the value of a forest is often reduced to its annual revenue yield of timber. How is the financial sector and our businesses accounting for nature dependencies?

As the global community grapples with the devastating consequences of nature loss and deforestation, the European Union (EU) has established stringent regulations for addressing deforestation, the European Union Deforestation Regulation (EUDR).

What is the likely impact of this regulation on local businesses that export any of the seven commodities under the EUDR? New global disclosure regulations, such as these are creating a new level of disruption and risk to business.

This means robust data collection systems and new data governance. The summit seeks to provide insights on how to navigate the evolving regulation and prepare local businesses and value chains to be fit for a sustainable future.

For example, in markets which are smallholder dominated like in Zimbabwe, how can it be ensured that smallholders are not removed from the supply chain and how can data be collected and passed along the supply chain from local producers securely?

Who would have imagined that Mercedes Benz would require production data, geo location data, and production period data, to mention a few data points, from a cattle farmer to report under the EUDR on its leather supply chain deforestation targets?

Energy crisis

High fuel prices, inflationary pressures and supply chain bottlenecks, the urgent need to accelerate the energy sector’s transformation to net zero, and geopolitical developments have created a potent mix of pressures and incentives for energy investors.

Most of the investment and effort to achieve net zero and combat the energy crisis has been directed towards the supply side. This has focused primarily on leveraging renewable energy sources to replace fossil fuel power.

Whilst this is important, it will not be sufficient on its own and we need much more impetus on the demand-side. We need to change the way we use energy and also improve the efficiency of our usage.

Business leaders are being challenged now, more than ever, to manage competing priorities, including, being responsible grid citizens, the pressure to engage meaningfully with communities and deliver social impact, the lack of reliable electricity provision hampering business efficiency, and the call for significant societal transitions towards renewable energy.

The required reconfiguration of businesses, societies, and economies to transition to renewable energy sources, places businesses at the centre stage of the energy transition.

Corporate purchasing power has been a key driver in the transition to cleaner energy systems around the world. But there is also increasing scrutiny of corporate clean energy and carbon reduction claims. Responsible grid citizens contribute to grid stability and environmental sustainability. What actions can industries take to lessen the load of their activities on the grid?

The summit will provide a unique opportunity for investors, end users and energy companies to explore economic opportunities, understand policy support, meet investor demand for sustainability, stay informed about technological advancements, and respond to market signals.

Whether exploring renewable energy adoption, enhancing energy efficiency or adapting lifestyles, this summit aims to empower attendees with practical knowledge and actionable steps to navigate and capitalise on opportunities in the evolving energy landscape.

In view of the global trilemma, how are businesses keeping sustainability at the top of the corporate agenda? How are chief executives and boards leading their organisations towards a more sustainable and profitable future?

Where sustainability and profitability conflict, how do you strike the right balance? As old business models fail due to climate change, how can organisations adapt and find new markets? Realign your business strategy in pursuit of a sustainable future with insights from the economics of climate change, business model innovation, unique case studies of corporate transition plans, climate adaptation, governance, disclosure and reporting standards and regulation.

With a confirmed diverse pool of speakers possessing global experience ranging from sovereign advisory, sustainability standards and reporting, E- mobility, renewable energy, construction and real estate, finance and banking, the summit presents a forward-looking collaborative platform for business, finance, government, and society to partner to accelerate sustainable action.

The summit is designed for C-suite executives, board members, professionals, managers, and individuals seeking to understand the practical applications of sustainability.

Whether you are looking to implement sustainability in your organisation's supply chain, explore circular economies, or understand ESG financial markets, this summit provides valuable insights and knowledge.

It caters to individuals seeking to navigate the practical side of sustainability and make informed decisions aligned with environmental, societal and economic benefit.

Broadcast to millions via the global Zimbabwe Independent network and Alpha Media Holdings’ Heart and Soul Television, there is no other meeting that puts partnership right at the centre of tackling the triple planetary crisis.

Opportunities to discuss solutions include:

Exclusive editorial interviews: Get first-hand insights from other leading C-executives on sustainability trends and developments that will impact your business.

Expert-led panels: Get your 360-degree view of climate, biodiversity and energy challenges as key voices from varied sectors debate critical issues.

Executive roundtables: Build relationships with fellow leaders committed to sustainable action and dive into burning issues behind closed doors.

Climate change, biodiversity loss and the energy crises are some of the defining stories of our age.

The Zimbabwe Independent is committed to reporting on our planet with integrity, independence, and freedom from bias. The 2024 Annual Sustainability Summit is an opportunity to explore together all aspects of the pressing global trilemma of our time for a sustainable future.

- Tapera is a certified expert in environmental, social and governance impact investing. — [email protected].