GLOBALLY, there is wide consensus amongst nations that the unfolding climate change crisis calls for urgent and concerted efforts to put in place measures to reduce greenhouse gas (GHG) emissions into the atmosphere.

Scientific evidence generated through many years of work by the Inter-Governmental Panel on Climate Change (IPCC) has demonstrated beyond doubt that these anthropogenic gases are the key drivers of global warming and climate change.

This has given rise to the concept of carbon credits. A carbon credit is equal to one tonne of carbon dioxide removed from the atmosphere.

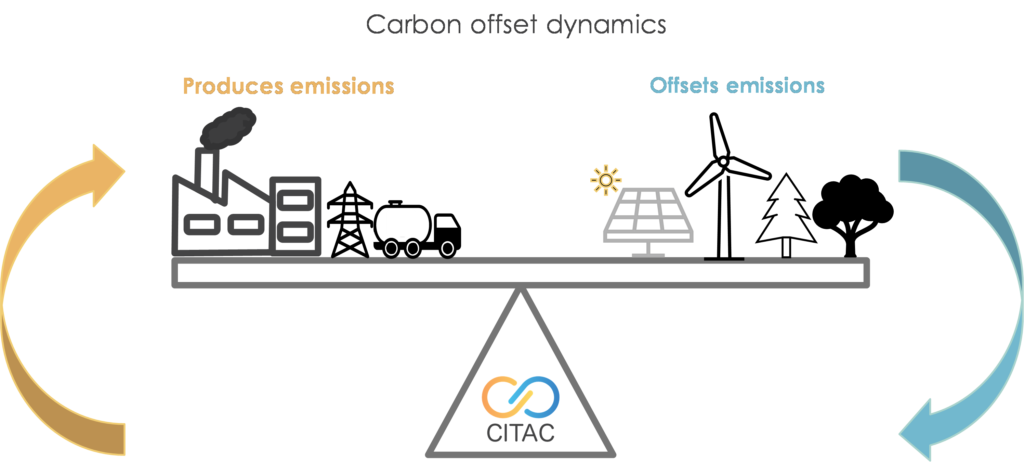

Therefore, carbon markets turn one tonne of carbon dioxide emissions into a commodity by giving it a price.

This can be accomplished through a variety of techniques, including planting trees and sustainable land management practices.

Carbon credits are a tradable instrument that represents a reduction or removal of greenhouse gas (GHG) emissions from the atmosphere.

They are a key component of carbon markets which can be bought or sold and are used by individuals, organisations, and governments to act on climate change and mitigate their carbon footprint.

Carbon credits are created through projects or activities that result in the reduction, avoidance, or removal of GHG emissions. These projects can be in sectors such as renewable energy, energy efficiency, forestry, methane capture, or other initiatives that contribute to emissions reductions.

- What if nations fail on climate change adaptation?

- How a country can achieve resilience in construction sector

- Quantifying Africa’s emissions for carbon credits

- Where do we stand on crucial climate matters?

Keep Reading

Buyers purchase carbon credits to offset their own emissions, while sellers offer credits generated from certified projects. Trading can occur in voluntary markets, where individuals or organisations voluntarily offset their emissions, or in compliance markets, where carbon credits are used to meet regulatory obligations, such as emissions caps or reduction targets.

The global carbon market is worth over US$1 trillion. Carbon credit trading was initiated under the Kyoto Protocol in 2007, then called the Clean Development Mechanism (CDM).

This mechanism was aimed at reducing emissions through carbon trading and flow of investment from developed to developing countries.

Carbon markets are an international market instrument that can trigger action towards emissions reduction and a cleaner environment. In a nutshell, carbon markets are important for improving economic efficiency and enhancing international cooperation in accelerating climate action.

There is scope for renewable energy developers to benefit from the carbon market trading systems, which are designed to incentivise the reduction of greenhouse gas emissions.

Renewable energy projects generate electricity from clean sources such as solar, wind, hydro and biomass. These projects have lower emissions compared to fossil fuel-based energy sources. Therefore, by generating renewable energy, developers can earn carbon credits which can be traded in the carbon market.

This revenue can supplement business income and improve the project financial viability. Participating in the carbon markets can help attract investors and lenders who are interested in supporting sustainable and low carbon initiatives and can help enhance the economic viability of the projects.

Carbon markets also have the potential to attract significant and meaningful finance to support forestry, biodiversity and sustainable natural resources management, scale up renewable energy development and promote climate resilience.

To effectively participate in the carbon markets, developers should familiarise themselves with the relevant policies, standards, and mechanisms governing the carbon markets and navigating the complexities associated with the carbon credit programmes.

There is need to foster domestic and international cooperation and collaboration between government, private sector, communities and international partners for improved realisation of carbon markets benefits.

The opportunity for investors includes (i) promoting liquidity via trading with secondary market brokers and (ii) providing financial support via direct financing or investing in suppliers of carbon-compensation.

Carbon allowances could also provide downside protection and enhance risk-adjusted returns in scenarios involving immediate and delayed climate actions.

We maintain a strong view that investors must plan the pathway to incorporate carbon markets as an asset class into their portfolios. Carbon credits present an upside opportunity for early-stage investors as the climate transition gathers pace.

In conclusion, given the physical climate risks that uncontrolled climate change poses for portfolios, investors should take interest by participating in the global carbon credit market.

- Matsika is a corporate finance specialist with Switz View Wealth Management. — +263 78 358 4745/ [email protected]