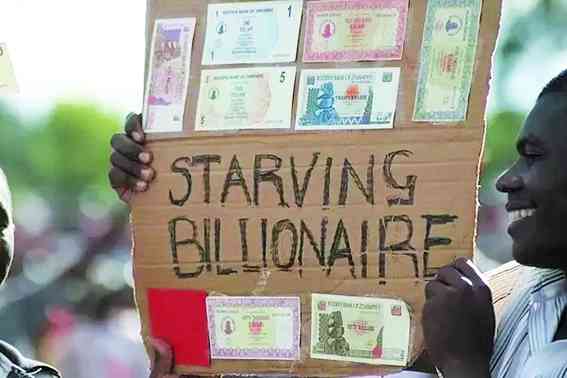

THE Consumer Council of Zimbabwe (CCZ) says the family basket has nearly doubled to ZWL$6,2 million from ZWL$3,6 million in December piling more misery on Zimbabweans that are struggling to make ends meet.

The rise in the cost of living comes on the back of a sharp depreciation of the local currency which has lost more than half of its value in a month.

This has pushed up prices of basic goods and services as they track the movement of the US dollar mark.

Month-on-month inflation rate for January 2024 was 6,6%, gaining 1,9 percentage points on the December 2023 rate of 4,7%.

Annual inflation quickened to 34,8% in January from 26,5% in December.

National statistics agency, ZimStat, said the increase in inflation was largely driven by the increasing cost of food and non-alcoholic beverages, which alone contributed 4,9% to the overall inflation rate.

At the root of Zimbabwe’s problems is the local currency which has lost the functions of money such as store of value, unit of account and medium of exchange.

Confidence in the Zimdollar is waning with eight out of 10 local transactions being done in the US dollar.

- Mthuli Ncube abandons struggling consumers

- Government moves to cushion pensioners

- Village Rhapsody: Zanu PF must commit to peaceful transition in 2023

- Could genomics bring answers to the Siyachitema Covid-19 bloodbath?

Keep Reading

Experts say the redollarisation of the economy is the solution to the exchange rate volatility, adding that the dual currency regime has failed as businesses opt for a stable currency. Last year, President Emmerson Mnangagwa extended the use of the multi-currency regime to 2030.

Authorities insist the local currency is here to stay.

Addressing ministers at the first Cabinet meeting of 2024 on Tuesday, Mnangagwa said prudent fiscal and monetary policies and the promotion of a conducive business environment remained critically important for the stability and growth of our economy.

He said fiscal and monetary authorities were implementing a “raft of policy measures to arrest price increases, stabilise the foreign exchange rate, maintain the value of our currency and ultimately encourage savings”.

However, it seems the measures have run out of steam as the local currency continues to depreciate.

The latest data from CCZ is a reality check for authorities that believe zvakarongeka (it is all in order).

They have painted a rosy outlook, illustrating that they are out of touch with reality.

Finance minister Mthuli Ncube is on record saying he has ticked all the boxes required for the growth of the economy.

The new family basket means that most of the workers in the country cannot afford to put food on the table and now constitute the working poor.

Government is the biggest employer and pays its workers US$300 plus a local currency component, way below the family basket amid fears of sour industrial relations as employees push for a salary review.

The civil servants have already indicated that they want the least paid to get US$800 monthly. Government will obviously say it has no resources.

Experts say redollarisation of the economy will remove currency headaches and stabilise prices.

They say the market has spoken by offering discounts on US dollar-priced products and punishing those that are paying in local currency.

Calls for the adoption of the US dollar as a sole medium of exchange will grow louder in the coming months as the redollarisation juggernaut rolls on.