ZIMBABWE’S leading legal and economic minds have strongly criticised the repeal of Section 22 of the Sovereign Wealth Fund Act, a controversial move that now allows authorities to use state enterprises as collateral for loans.

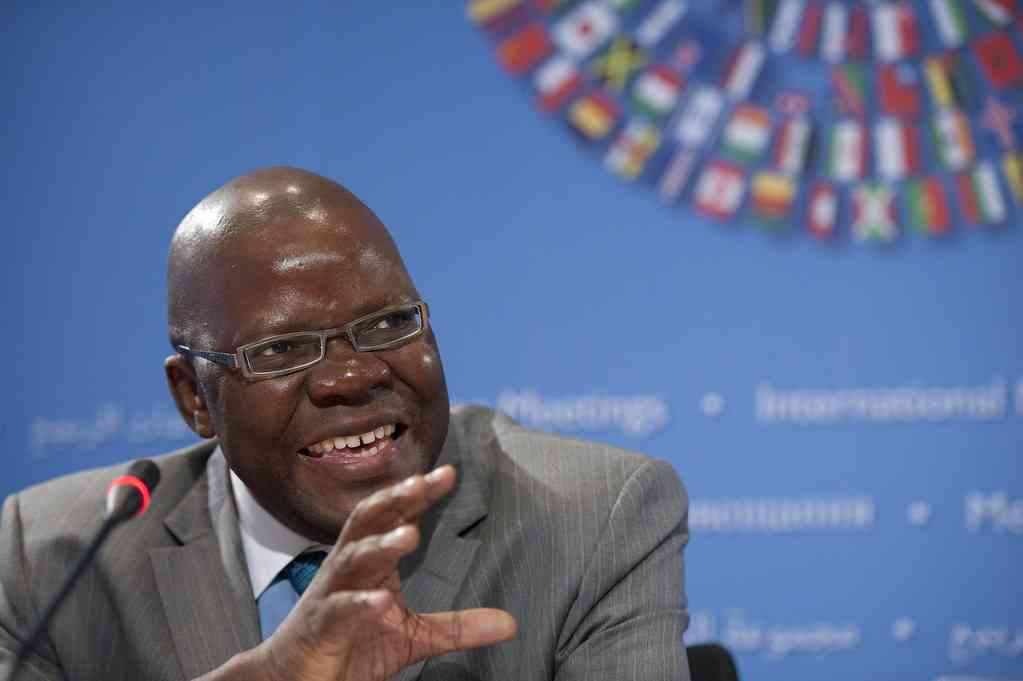

The repeal has sparked swift reactions from key figures, including former finance minister Tendai Biti and trade economist Gift Mugano, the executive director at Africa Economic Development Strategies.

The uproar follows a red flag raised by Veritas, a legal think tank, which highlighted that the amendment was pushed through without parliamentary approval.

Veritas warned that the changes enable authorities to use assets from over 30 state entities under the Mutapa Investment Fund (MIF) as loan security.

Critics fear this development could lead to a significant increase in national debt and the potential loss of strategic assets.

Experts pointed out that Zimbabwe has a long history of debt default, with outstanding obligations totalling US$21 billion — approximately 59% of GDP, as reported by the public debt management office last month. A substantial portion of this debt consists of arrears.

Biti described the repeal as “outrageous”, alleging it was secretly inserted into unrelated legislation to avoid public scrutiny.

“You will notice that the repeal is done through the Finance Act, and it is also done through the Administration of the Estates Amendment Act,” Biti said. “So, how do you sneak into the Administration of Estates Act to deal with state assets?

- New Perspectives: Gold coins alone will not tame Zim’s inflation

- Fears of jobs carnage as crisis deepens

- Binga to Rwanda: ED’s dilemma

- New Perspectives: Gold coins alone will not tame Zim’s inflation

Keep Reading

“This is clearly a scam. You cannot just sneak in such an important provision in a very innocuous Bill that deals with a completely different subject matter, the issues of deceased people’s assets.

“It was also sneaked into the Finance Act, and the Finance Act is a money Bill. The Finance Act should only deal with finance issues (such as) revenue and taxes. So, this is breaking the constitution of the country.”

He accused the government of dishonesty, asserting that neither parliament nor the public had an opportunity to debate the repeal.

“This whole thing reflects how dubious and dishonest (Finance minister) Mthuli Ncube is to put a law at a point that the parliamentarians or members of the public cannot debate it,” Biti said.

“Now the repeal of Section 22 of the Sovereign Wealth Fund means they can borrow and collateralise the country’s hard-earned assets without parliament’s approval or scrutiny.

“This is broad daylight theft. This repeal will mean that the government will accrue debt through these assets, and the debt burden will fall on the taxpayer. So, it is outright scandalous.”

Experts also said mortgaging the fund’s assets would diminish their value. They said if the government defaulted on its loans, the assets risked being seized and lost forever. If the country fails to pay its debts, creditors may seize the attached assets, further exacerbating the crisis.

Mugano warned that Zimbabwe’s history of defaulting on debts may lead to a loss of assets under the fund due to the repeal.

“For me, this is a disaster because of our history of non-payment of debt,” he said.

Mugano’s concern was the rapid increase in debt, driven by excessive borrowing.

He estimated that Zimbabwe may accumulate an additional US$2,5 billion to US$3 billion in debt this year due to wasteful capital expenditure and budget deficits.

“Now that Section 22 has been repealed, all these companies and their assets can be used as collateral against debts — not just debts of the Mutapa Investment Fund, but also government debts, parastatal debts and, conceivably, debts of politically-influential individuals,” Veritas said in a legal note.

“With the repeal of Section 22, this prohibition has fallen away, and the board (of MIF) is now free to mortgage the fund’s assets and pledge them as the board thinks fit.”

Much of Zimbabwe’s debt stems from loans taken over 20 years ago. More recently, the country has relied on Chinese lenders to fund projects, such as the Hwange power station, airport upgrades and water system rehabilitation.

In its analysis, Veritas said: “It is probable that the Chinese lenders are understandably afraid that Zimbabwe may default on its debts and want to hold collateral on some of the assets they funded, as they have done in Zambia and Tanzania.

“While it is understandable for creditors to want security for the money they have lent the government over the years, it is unfortunate that they have been granted their wish in this manner.”

China is owed about US$2,07 billion by Zimbabwe.

In August 2022, Ncube revealed Zimbabwe had secured a US$200 million loan from China for farm mechanisation equipment.

However, the government had used platinum worth a staggering US$27,87 billion as collateral to secure the loan.

“If the (IMF) board decides to mortgage assets of the fund — which are national assets — to appease the country’s creditors, they will be able to do so without first securing approval from parliament,” Veritas said.