THE newly-established Zimbabwe Renewable Energy Certificate (ZimREC) platform is set to enhance liquidity by monetising bankable energy projects, according to Africa Institute for Carbon Trading and Sustainability (AICTS) chief executive officer Kudakwashe Manyanga.

ZimREC, an initiative by AICTS in partnership with Silver Carbon, aims to create a trading platform for Renewable Energy Certificates (RECs) on behalf of independent power producers (IPPs).

RECs are tradable, non-tangible certificates that represent the environmental attributes of one megawatt-hour (MWh) of renewable electricity generated and fed into the grid.

Manyanga explained that when RECs are traded on the ZimREC platform, IPPs will receive payments in US dollars, providing a new revenue stream.

This initiative comes at a time when Zimbabwe’s renewable energy potential is estimated to range between 1 500 megawatts (MW) and 2 000MW.

“There are constant funds that are flowing to those applications. The more power you are generating, the more liquid you are in the process,” Manyanga said.

He further elaborated that any producer generating up to 1MWh of renewable energy would be eligible for compensation, with each REC representing 1MWh of power produced.

However, Manyanga noted that discussions with the financial sector were still ongoing to address collateralisation issues and ensure that RECs are recognised as tradable financial instruments.

- Meet the man behind Takura’s Haarore

- Meet the man behind Takura’s Haarore

- ZimRec seeks to transform energy sector

Keep Reading

“We are doing the rest on IPPs’ behalf, so it is just a payment that comes to them as well. As long as you are producing power on a monthly basis, every megawatt per hour of power produced with evidence, you are paid for that,” Manyanga said.

“So, IPPs register through the ZimREC platform, and then we do the verification whether there is evidence of the power produced.

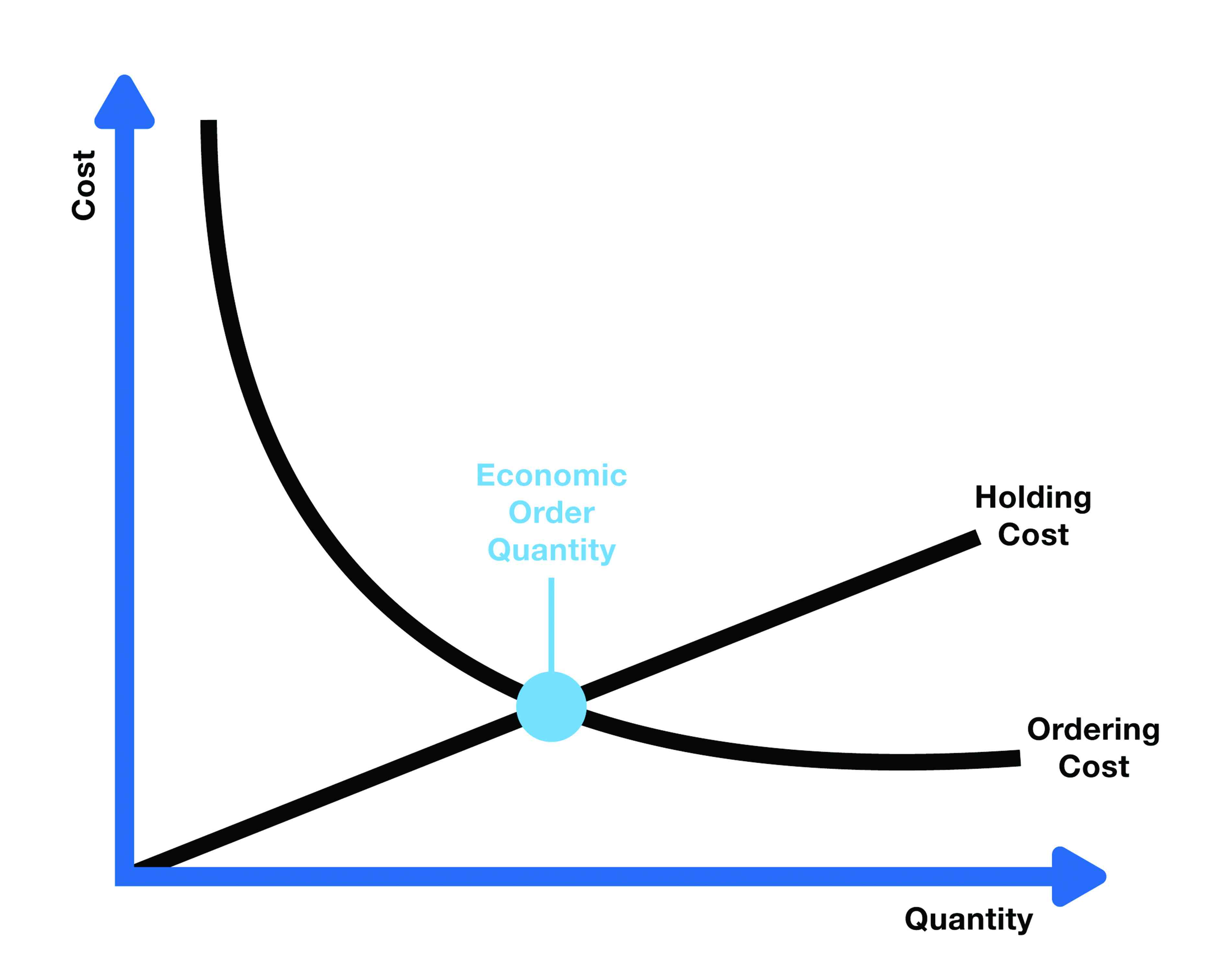

“How much it will sell varies within the region based on various factors as well, including geography and supply and demand.

“In other markets, we are looking at in excess of US$25 per REC on the Australian market. In other regions, it is around US$3 per REC; and in South Africa, it is ZAR30 (US$1,65),” he added.

Manyanga expressed optimism that ZimREC would incentivise growth in this area.

“That is our hope, but currently the challenge is that the number of installed capacity is still very low,” he said.