MANY companies are criticised for paying top executives excessively while underpaying lower-level employees.

Having worked with salary data for years, I find it surprising how often this happens — even when companies have access to market information. Poor salary structures, uninformed pay decisions and unsustainable wage policies can lead to talent loss, low morale, and financial strain.

First rule of pay

The first rule of pay is simple: do not offer salaries you cannot afford in the long-run. Many organisations increase salaries reactively without assessing the long-term financial impact.

Salary hikes that are not aligned with revenue growth create financial instability, forcing companies into difficult cost-cutting measures later.

A more strategic approach is to offer performance-based bonuses or one-time incentives rather than across-the-board salary increases. These alternatives allow companies to reward performance without permanently increasing fixed costs.

At the executive level, maintaining a fair and justifiable pay gap between the chief executive officer (CEO) and regular employees is critical for trust and morale.

Excessive gaps between top management and the workforce can lead to disengagement and resentment, which ultimately affects productivity.

- Role of the human resources director

- Blanket resource bigger than previous estimates

- HR professionals make the best CEOs

- Smart pay decisions: Balancing salaries, business sustainability

Keep Reading

CEOs and boards should carefully evaluate executive compensation structures to ensure they align with both internal pay scales and external market benchmarks.

Data-driven pay decisions

Compensation decisions should be guided by clear policies, market research and strategic business needs rather than intuition or ad-hoc adjustments.

Employees should understand why some roles earn more than others and organisations must communicate pay structures transparently to prevent frustration and demotivation.

If market data reveals that a company is paying below industry standards, it is important to resist the urge to increase all salaries indiscriminately.

Instead, focus on retaining top performers in key roles — those whose contributions are critical to business success.

A common pitfall in pay management is adjusting salaries without properly benchmarking against competitors or assessing the real impact on business performance.

Another major mistake is paying market rates for employees, who are not delivering value. Simply offering competitive salaries without linking pay to performance results in an inflated wage bill without corresponding improvements in productivity.

Smart compensation strategies ensure that employees, who contribute the most receive the highest rewards while maintaining overall financial sustainability.

Unexpected reality

Having led salary surveys across almost every sector for over 20 years, one reality has remained clear — some junior roles pay significantly more than higher-level positions.

This is primarily due to factors such as industry demand, specialised skills, company size and business dynamics.

For example, we have seen cases where accountants earn more than finance managers in low-wage sectors — and, in some instances, even more than finance directors.

Similarly, highly-specialised roles in human resources (HR), supply chain, marketing and engineering sometimes command salaries higher than general management roles. This phenomenon is not an anomaly, but a market-driven reality.

One consequence of this trend is that many mid-level managers hesitate to move into senior roles because they are already earning more — sometimes even three times what the promotion offers. When pay structures do not align with career progression, employees are less motivated to seek advancement, which can create stagnation in leadership pipelines.

Companies need to acknowledge these realities and design compensation strategies that align with both market trends and internal equity.

This may involve restructuring career progression paths to include non-monetary incentives, such as leadership opportunities, project-based bonuses, or enhanced benefits to make promotions more attractive.

Same grade, same salary

One of the most common questions I receive is: Do employees in the same job grade have to earn the same salary?

The answer is — it depends. It primarily depends on whether the organisation intends to reward performance or not.

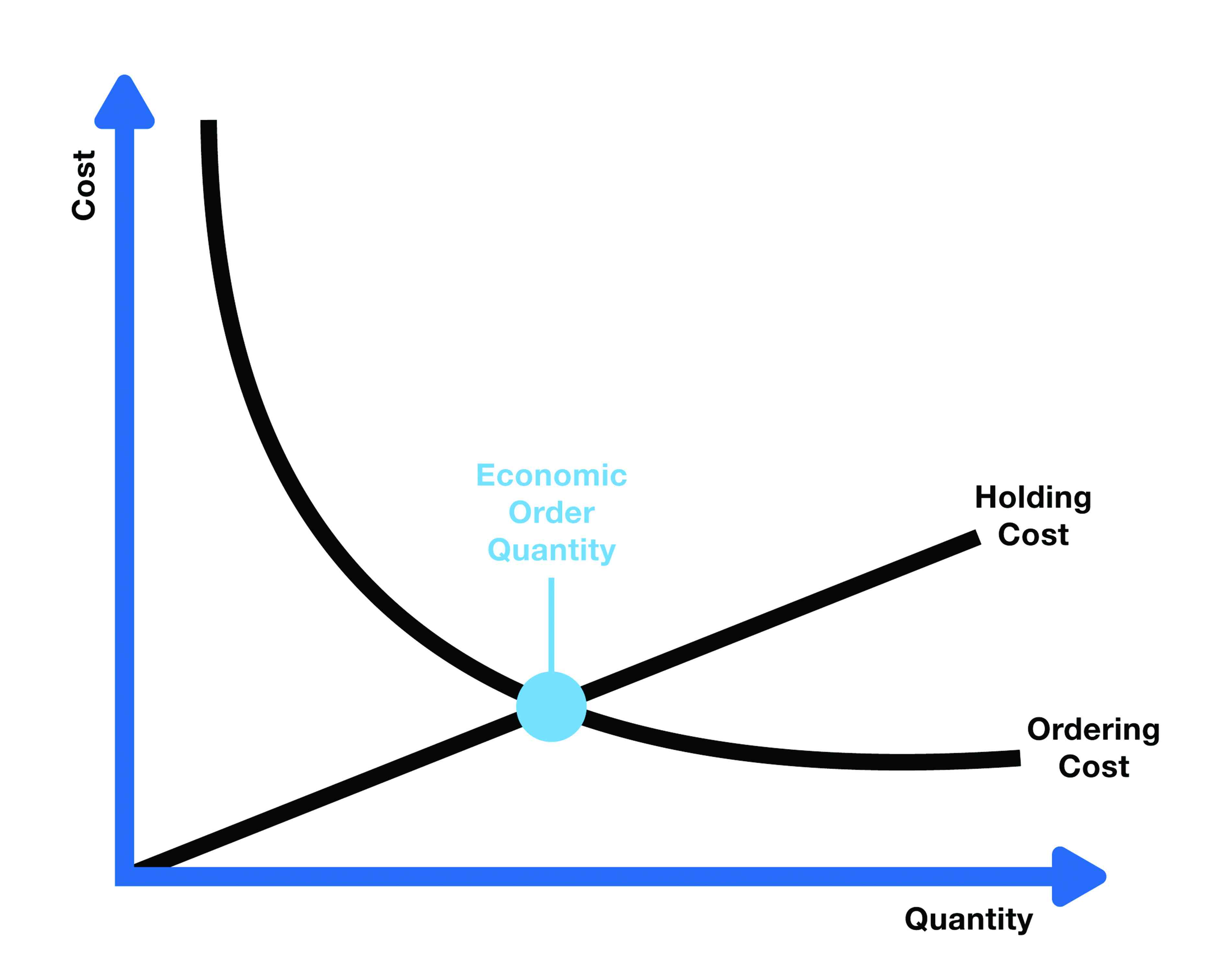

If a company values and recognises performance, it is best practice to differentiate salaries within the same grade. This is why, after job grading, we encourage companies to establish a pay structure that includes a minimum, midpoint and maximum salary per grade. Such a structure acknowledges that employees within the same grade contribute different levels of value to their roles.

Failing to differentiate pay within a grade can lead to pay compression — a situation where there is little to no difference in pay between employees, regardless of differences in performance, experience or tenure.

Pay compression can demotivate high performers, reduce retention of top talent and weaken an organisation’s ability to attract skilled professionals.

A well-designed and competitive pay structure should accommodate whatever compensation policy the organisation chooses to pursue — whether it prioritises internal equity, performance-based pay or market competitiveness.

The case for paying unfairly

One of the best pieces of advice I have ever heard is: “pay unfairly”. Your top performers should earn significantly more than your average employees. This is standard in sports, yet few corporate leaders apply it. Why?

If you do not reward your best people proportionally, you end up with an unsustainable wage bill — spreading salary dollars too evenly across employees who contribute vastly different levels of value.

The result? You risk losing your top talent while overpaying those who deliver less.

Many companies resist this approach due to concerns about internal equity, perceived fairness, and the potential for employee dissatisfaction.

However, a rigid approach to salary fairness often leads to mediocrity rather than excellence. High performers drive disproportionate value to the business and should be compensated accordingly to ensure retention and motivation.

What do you think? Why do so many companies resist this approach?

Striking a balance

Organisations that make smart pay decisions balance fairness, business needs, and long-term financial health. To achieve this, consider the following best practices:

A well-thought-out pay strategy enhances employee trust, improves retention and ensures financial stability. When compensation decisions are made strategically — balancing market trends, performance and long-term affordability — organisations can create a fair and sustainable pay structure that benefits both employees and the business.

Ultimately, the goal is not just to match industry salary benchmarks, but to develop a compensation framework that supports business growth, attracts and retains top talent and fosters a motivated and engaged workforce.

Smart pay decisions should never be reactive or driven by external pressure — they must be informed, strategic and aligned with long-term business goals.

And one more thing: a company’s pay structure is not just about numbers — it is about people. The way an organisation compensates its employees reflects its values, priorities and long-term vision.

Making smart pay decisions is not just a financial choice; it is a strategic move that shapes workplace culture, productivity and business success.

- Nguwi is an occupational psychologist, data scientist, speaker and managing consultant at Industrial Psychology Consultants (Pvt) Ltd, a management and HR consulting firm. — Linkedin: Memory Nguwi, Mobile: 0772 356 361, [email protected] or visit ipcconsultants.com.