GLOBALLY, there have been massive campaigns amongst financial industry players and regulators against money laundering and terrorist financing.

This is because the international community has witnessed the use of increasingly sophisticated methods to move illicit funds through financial systems across the globe.

This has also called for the need of improved multi-lateral cooperation to fight these criminal activities.

Money laundering can be defined as the process by which proceeds from a criminal activity are disguised to conceal their illicit origins.

Basically, money laundering involves the proceeds of criminally-derived property rather than the property itself.

On the other hand, the financing of terrorism is the financial support, in any form, of terrorism or of those who encourage, plan, or engage in terrorism.

As highlighted, money laundering is a crime that disguises where money came from — usually because its source was illegal.

The most common types of criminals, who need to launder money, are drug traffickers, embezzlers, corrupt politicians and public officials, mobsters, terrorists and con artists.

- Rampaging inflation hits Old Mutual . . . giant slips to $9 billion loss after tax

- Monetary measures spur exchange rate stability: RBZ

- Zim deploys IMF windfall to horticulture

- Banker demands $21m from land developer

Keep Reading

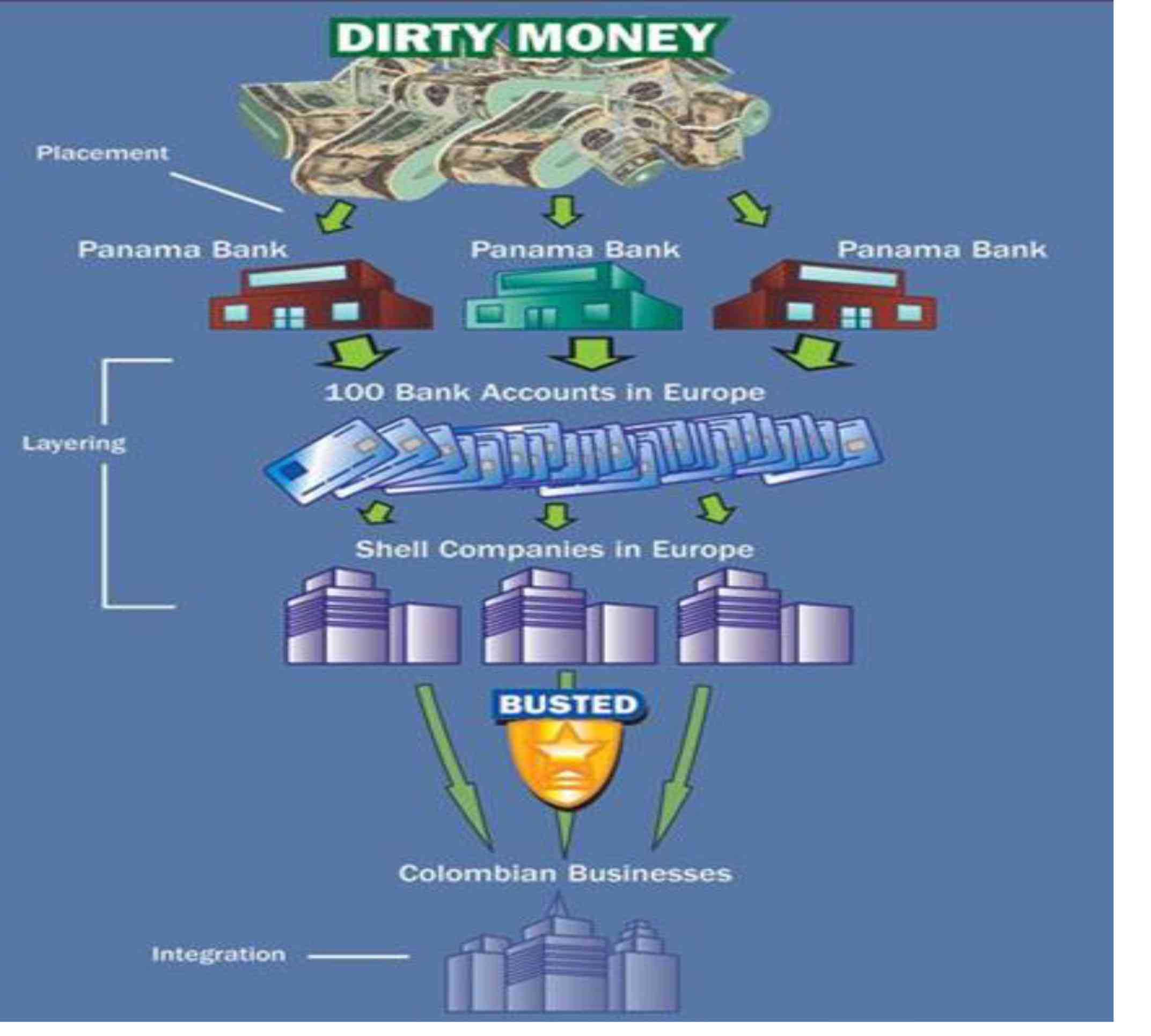

The basic money laundering process has three steps outlined below:

Placement

At this stage, the launderer inserts the dirty money into a legitimate financial institution. This is often in the form of cash bank deposits.

This is the riskiest stage of the laundering process. This is the reason why most regulators require banks to report high-value transactions.

Layering

This involves sending money through various financial transactions to change its form and make it difficult to trace.

Layering may consist of several bank-to-bank transfers, wire transfers between different accounts in different names in different countries.

This makes deposits and withdrawals to continually vary the amount of money in the accounts, changing the money's currency and purchasing high-value items (boats, houses, cars or diamonds) to change the form of the money.

This is the most complex step in any laundering scheme and it is all about making the original dirty money as hard to trace as possible.

Integration

At the integration stage, the money re-enters the mainstream economy in legitimate-looking form. This may involve a bank transfer into the account of a local business in which the launderer is "investing".

It is generally very difficult to identify a launderer during the integration stage.

Overall, money laundering is a crucial step in the success of drug trafficking and terrorist activities.

The fact that global financial systems play a major role in most high-level laundering schemes means that the international community must play a big role in fighting money laundering through various means, such as the Financial Action Task Force on Money Laundering (FATF).

The United Nations, the World Bank and the International Monetary Fund have also set up anti-money-laundering divisions.

In Zimbabwe, regulators such as the Reserve Bank of Zimbabwe (Financial Intelligence Unit) and the Securities and Exchange Commission of Zimbabwe (SecZim) have put in place strict guidelines aimed at curbing money laundering activities.

The fact that securities markets can be used as a layering or integration channel means that market participants adhere to strict KYC (Know Your Client) policies. There are also platforms that have been set up to report any suspected laundering activities.

- Matsika is a corporate finance specialist with Switz View Wealth Management. — +263 78 358 4745/ [email protected]