Hope for lifting ban on OM, PPC chips

They faced the embarrassment of being forced out because their stocks were on a bull run. It is baffling that investors have had to wait for two years, given the importance of the matter at hand.

Gono was running out of options after being confronted by blowbacks from a crisis that had been nurtured by looters well before he accepted the most difficult task to apply breaks on the carnage.

Contrary to his defence, the Zimbabwean dollar is today an albatross to the search for solutions to a blazing crisis. The economy is burning and chaos is reigning supreme everywhere. True, solutions to problems that have been created over many years of looting may be difficult to find immediately. This is why Ncube, frustrated by lack of progress, resorted to emotionally charged decisions, such as punishing Schweppes for taking a position that would save its operation and keep people in their jobs.

Zimbabwe must get back to serious business after losing 22 years of production, which has had implications on gross domestic product, industrial and farming output. Resentment and confrontations, characterising government and business’ engagements, have worked against everyone. When chief executive officers were pushed into hiding during a crackdown over foreign currency last year, it was the economy that suffered because key decisions were delayed.

In 2021 the Confederation of Zimbabwe Industries (CZI) said manufacturing firms required US$2 billion to return to pre-crisis capacity levels.

SINCE Zimbabwe’s gold and diamond fields descended into complete chaos about a decade ago, nerve-wrecking statistics have been thrown around demonstrating the extent to which meltdown-hit Harare has been strangled by policy missteps. It has been an era of carnage and bloodbath. The most infamous of such data was the late former strongman Robert Mugabe’s […]

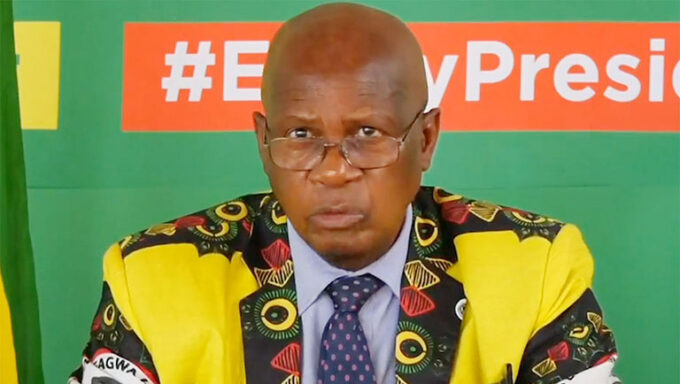

Zimbabwe’s Finance minister Mthuli Ncube belongs to both. But his recent attempt to mislead Zimbabweans into accepting that the economy is stable in the midst of excruciating pain is not only an insult to an educated population but also at variance with what is expected of bankers.

Zimbabwe has been thrown into turmoil by reckless Chinese miners. They are untouchable because they enjoy the protection of government officials. Amid widespread outcries over their destructive tendencies, the Chinese have been on the warpath digging up riverbeds and blasting away mountains to extract minerals.

Turkish Airlines will open up new tourism source markets from regions currently under served, such as Eastern Europe, parts of the Middle East and Asian economies, where some of the world’s fastest expanding economies with high spending middle classes are found.

Despite evidence that the Zimbabwe dollar faces rejection by the market because of its decline in value, the government chooses to stick its head in the sand declaring that the country is heading towards dedollarisation by 2027.

This is where central bank governor John Mangudya’s role gets complicated. His bosses are not afraid of destroying markets by managing banks. Zimbabwe’s politicians have the benefit of hindsight, having previously destroyed this economy in 2008.

The Confederation of Zimbabwe Industries (CZI)’s 2021 Manufacturing Sector Survey released on Wednesday showed 56,25% of combined installed plant capacity was productive last year.

Dorowa is only a small fraction of a huge, ailing fertiliser empire mostly controlled by the state through the Industrial Development Corporation of Zimbabwe. Having underpinned agriculture for up to seven decades in some cases, most of these assets are now nothing but heaps of mangled steel and graveyards of insolvent enterprises.

The entire decision-making process with regards to mining deals must be reviewed to help Zimbabweans. This is not to say foreign investors are evil. Businesspeople are motivated by profit, and would do anything to keep costs down. It is the duty of governments to put in place systems to level the playing field.

Among the revelations are a failure by Treasury to reconcile more than US$300 million in foreign direct payments on behalf of 16 ministries as well as the purchase of vehicles, laptops, Samsung Galaxy tablets and school desks, which were never delivered.

The most basic indications pointing to more troubles ahead include the exchange rate crisis. The Zimbabwean dollar has not gained against the United States dollar in the past two months and it is losing traction by big margins, especially on the black market.

Zanu PF has always been uncomfortable with Old Mutual and PPC for decades and took the bull run as a pretext to show that they were in power. But economies and stock exchanges are ruled by market forces. Since the three counters were sacked and directed to seek listings on the Victoria Falls Stock Exchange (VFEX), many problems have surfaced.

The Reserve Bank of Zimbabwe, which has been battling to distribute the little foreign currency flowing into the country, looked forward to the tobacco marketing season to address many issues that confronted the volatile economy.

A case in point is at Dorowa Minerals, which is being rebuilt through the exportation of by-products of its production system, with funds being ploughed back.

Red lights are flicking across markets, and this could be a precursor to more complex and difficult times ahead.

In Zinara’s case they are aware that roads are collapsing when known looters are living large at the public’s expense. When the Zimbabwe Anti-Corruption Commission was given sharp teeth to bite after the coup in 2017, Zimbabweans looked forward to results. Today, they are disappointed.

In many of his addresses, Chinamasa swung away from Zanu PF’s ruinous stance against capital, defending the mining industry, which he was convinced held answers to most of Zimbabwe’s myriad woes.

They faced the embarrassment of being forced out because their stocks were on a bull run. It is baffling that investors have had to wait for two years, given the importance of the matter at hand.

The airline that he accepted to superintendent is bleeding on a sea of fronts. And success in executing its turnaround strategy would solely depend on the government’s willingness or capacity to pump in fresh capital to save an already desperate situation.

Along with foreign direct investment (FDI) inflows into mines, Zimbabwe has granted several big investors rights to set up power guzzling smelters to process chrome and other minerals under the value addition strategy.

Gono was running out of options after being confronted by blowbacks from a crisis that had been nurtured by looters well before he accepted the most difficult task to apply breaks on the carnage.

Contrary to his defence, the Zimbabwean dollar is today an albatross to the search for solutions to a blazing crisis. The economy is burning and chaos is reigning supreme everywhere. True, solutions to problems that have been created over many years of looting may be difficult to find immediately. This is why Ncube, frustrated by lack of progress, resorted to emotionally charged decisions, such as punishing Schweppes for taking a position that would save its operation and keep people in their jobs.

Zimbabwe must get back to serious business after losing 22 years of production, which has had implications on gross domestic product, industrial and farming output. Resentment and confrontations, characterising government and business’ engagements, have worked against everyone. When chief executive officers were pushed into hiding during a crackdown over foreign currency last year, it was the economy that suffered because key decisions were delayed.